Statistics guru Hans Rosling debunks myths about the so-called “developing world.”

SCMP Forum

Singapore is far better than Hong Kong

Updated on Mar 22, 2009

I refer to the article “Singapore beats HK in survey of Asian expats”, March 12.

That “Singapore appears to have finally achieved its dream of being better than Hong Kong” was a highly laughable comment. Singapore has achieved the same status at the top for the past 10 years.

I am a European expat who stayed (or, more rightly, suffered) in Hong Kong for close to five years but chose to move to Singapore and obtained permanent resident status there (though I need to adjust my highly lucrative Hong Kong expat package in exchange).

My family and I are now enjoying the comforts, stability, safety and cleaner air of Singapore (plus the many more nice places and resorts that we can travel to in less than two hours, and the much more advanced and lively dining and entertainment options). This contrasts with the dirty and mundane, yet much more expensive Hong Kong.

But most important is the ease and efficiency of getting things done in a language I am more comfortable with, English. In fact, Singapore is so much more attractive than Hong Kong that I have the in-principle approval from our global headquarters to shut our office in Hong Kong and move it to Singapore, while maintaining a stronger presence in Shanghai.

Singapore beats Hong Kong in so many areas. Many friends are now making plans to move to Singapore after realising their misconceptions about the city.

Singaporeans may not be upfront with their thoughts and appear to be reserved, but I have made more local friends than I did in Hong Kong. At least, they are not like most arrogant but ignorant Hongkongers who think they know it all, and criticise and comment on almost everything and anything.

I can’t help but find most Hongkongers just a bunch of empty vessels, and definitely NATO (no action, talk only idiots – that’s how Singaporeans would describe Hongkongers).

Simon Morliere, Singapore

Singaporeans have a high regard for Hong Kong and its citizens

I refer to the letter by Simon Morliere (‘Singapore is far better than Hong Kong in every way’, March 22).

I assume that Mr Morliere is just expressing his personal opinion and not the opinion of the thousands of expatriates, including Singaporeans, living and working in Hong Kong nor Singaporeans in general. It is rather sad that he chooses to see Hongkongers in this manner.

I have lived in Hong Kong for the past 11 years and I find Hongkongers intelligent, hardworking, enterprising, open-minded, innovative, charitable and, most importantly, very tolerant towards non-Hongkongers.

Hong Kong is probably one of the safest places to bring up a family, with its efficient police and security forces, very high standards of education that provide a multilingual medium of instruction and also a multi-ethnic living environment.

As a member of the Singapore Chamber of Commerce (Hong Kong), I am fortunate to have the opportunity to interact with Hong Kong people from different walks of life and I personally feel that Hongkongers are one of the friendliest and most caring people in the world.

They are fast and efficient in their work, and, as far as I know, Singaporeans do not have the impression that Hongkongers are people who talk only and take no action.

Singaporeans living in Hong Kong are very appreciative of the inclusive society that Hong Kong is, where visitors and residents originating from other countries are invariably treated well by Hongkongers.

Vincent Chow, honorary executive director, Singapore Chamber of Commerce (Hong Kong)

Expat friends made the right choice

I would like to take this opportunity to thank my expat friends for having the wisdom and maturity to choose Hong Kong over Singapore.

Thank you for appreciating Hong Kong’s diversity and seeing sterility for what it is, for making the effort to find out more about the local culture and for enjoying all the services and amenities on offer. Thanks for being aware that a lack of local language ability will, of necessity, limit a foreigner’s exposure, in terms of both social milieu and intellectual stimulation.

And finally, to those with the good fortune to get perks that afford an expatriate lifestyle – as well as those who enjoy this to a more modest degree – thank you for being able to relate to locals who are suffering so much uncertainty and/or unemployment.

Some of you have also been affected by the economic downturn, but those qualities will stand you in good stead to make a quick recovery. Singapore’s heavy reliance on foreign businesspeople like Mr Morliere has led it to experience its worst gross domestic product slump.

Let’s hope Hong Kong’s government continues to show wisdom and maturity by investing in and fortifying the diversity and community spirit that will be key to maintaining the city’s resilience.

Angela Tam, Mid-Levels

Both cities have a lot going for them

After reading Simon Morliere’s anti-Hong Kong diatribe (‘Singapore is far better than Hong Kong in every way’, March 22), I felt that the sensible reaction was momentary contempt, and then to move on. Mr Morliere’s ill-considered scorn was simply not worthy of response – except that he included insults, which do need a response.

What is it about expatriates who move from Hong Kong to Singapore and then, having experienced the many fine pleasures of Singapore, feel constrained to trash Hong Kong in comparison, simultaneously and seamlessly morphing personal experience into general conclusions?

If Mr Morliere ‘suffered’ here for five years (despite his ‘highly lucrative . . . expat package’) one wonders about his ability to make dispassionate observations.

For example, to describe dining in Hong Kong as much less advanced and lively than in Singapore is, at best, crass.

Hong Kong deservedly has a reputation for fine and varied dining matched by few other places.

Singapore also has great eating, which raises the question – why this compulsion to make negative comparisons?

Singapore and Hong Kong, like anywhere else, have their pluses and minuses.

Hong Kong does indeed have awful air and water pollution and the government still has to get to grips with it.

Singapore is something of a nanny state, with a controlled press, but in both cities the pluses far outweigh the minuses.

Both are safe, efficient, have generally very capable civil services, great transport infrastructure, the best airlines in the world, a thriving cultural life and lots of interesting places to visit nearby, to name a few positive attributes.

Neil M.D. Russell, Discovery Bay

Success in Life

Here’s a funny TED video by Richard St. John on the 8 drivers of

success in life. Remember CRAP – criticism, rejection, assholes and

pressure.

http://www.ted.com/

http://www.richardstjohn.com/

Welcome to the Terrordome

Asset Bubbles

Above & Beyond pres. OceanLab – On A Good Day

GIC cuts loss in one fell swop

See also

http://chenreiki.com/blog/archives/376

http://chenreiki.com/blog/archives/350

http://chenreiki.com/blog/archives/327

Mon, Mar 02, 2009

The Business Times

GIC cuts loss in one fell swop

By Conrad Tan

THE Government of Singapore Investment Corp (GIC) will convert all its preferred shares in Citigroup into common stock to cut its losses. The swop will give it an 11.1 per cent stake in the troubled US bank, which yesterday announced a sweeping plan to boost its common equity base. The conversion will pare GIC’s paper loss on its original US$6.88 billion investment in Citi from 80 per cent or US$5.5 billion to 24 per cent, or US$1.67 billion, based on Thursday’s closing price of US$2.46 for Citi shares.

Separately, Citi said yesterday that it plans to swop up to US$52.5 billion of its preferred stock, including US$25 billion of the US$45 billion held by the US government, for ordinary shares.

Citi also recorded a massive US$10 billion charge for impairment of goodwill and other intangible assets in the fourth quarter, resulting in an additional net loss of US$9 billion for the final three months of last year.

For GIC, the decision to convert its shares appears to have been the lesser of two unpalatable choices. Citi yesterday suspended dividend payments on its preferred shares as well as common stock, which means that GIC would lose the 7 per cent annual dividend that it has been receiving if it chose not to convert its holdings.

The conversion will make GIC the second-biggest shareholder in Citi with a stake of about 11 per cent, compared to about 4 per cent at the time of its original investment. The US government will be Citi’s largest shareholder, owning 36-38 per cent of Citi’s common equity. The final stakes will depend on how many investors in the publicly held tranche of Citi’s preferred stock decide to participate in the share conversion.

One thing is certain: Existing ordinary shareholders will suffer massive dilution of more than 70 per cent. Citi shares plunged 37 per cent to US$1.55 at the start of US trading yesterday after the bank’s announcement. At that price, GIC’s unrealised loss on its Citi investment would be US$3.6 billion. The profitability of US banks ‘is likely to be impaired in the next two years’, said Ng Kok Song, GIC’s group chief investment officer in a statement.

‘GIC’s view is that with this latest move, Citigroup’s capacity to weather the severe economic downturn will be strengthened.’

Before yesterday’s announcement, the market value of the preferred shares held by GIC had already slumped 80 per cent to just US$1.376 billion since its initial investment in Citi, as mounting losses made it less likely that the bank would be able to keep up its dividend payments.

The US government, GIC and other investors that bought Citi preferred stock alongside GIC in January last year will receive common stock at a price of US$3.25 a share. Those investors, including Saudi Arabia’s Prince Al-Waleed bin Talal, have agreed to the exchange, said Citi.

At the conversion price of US$3.25, GIC will get some 2.12 billion common shares in exchange for its US$6.88 billion in preferred stock. Based on Thursday’s closing price of US$2.46 a share, GIC’s stake after conversion is worth US$5.21 billion.

That puts GIC’s unrealised loss on its original US$6.88 billion investment in Citi at US$1.67 billion after the conversion, compared to US$5.5 billion before.

Under the original terms of GIC’s investment in Citi, it would have had to pay a much higher conversion price of US$26.35 for each common share, GIC said. That would have translated into a stake of just 261.1 million shares, worth a mere US$642 million at Thursday’s closing price for Citi shares.

But the conversion also means that GIC will now bear greater risk than before, as an ordinary shareholder. It also gives up for good the 7 per cent annual dividend that it previously earned on its preferred shares.

Citi chief executive Vikram Pandit said that the conversion plan had just ‘one goal’ – to increase the bank’s tangible common equity or TCE. Converting its preferred shares into ordinary equity will boost its TCE ratio – the focus of stress tests by US regulators starting this week as a key measure of the bank’s ability to withstand further losses if the recession is worse than expected.

Ordinary shareholders are the first to suffer any losses, so common equity is seen as the highest quality of capital that a bank holds, and the size of a bank’s common equity base relative to its assets is considered the purest measure of its buffer against losses.

The hope is that by raising its TCE ratio, Citi will be able to weather the worst recession that the US has seen in decades. The plan is expected to increase its TCE as a proportion of its risk-weighted assets from less than 3 per cent now to 7.9 per cent.

Crucially, it does so without the need to inject more money from the public purse. That makes it unnecessary for the US government to seek the approval of lawmakers for more funds amid growing public fury over the use of taxpayers’ money to bail out large banks.

But the US government could still inject more capital into Citi – in the form of mandatory convertible preferred shares – if the stress tests show that the bank’s capital cushion still needs bolstering. That would mean further dilution for ordinary shareholders, including GIC, when the shares are eventually converted to common stock.

‘As a shareholder, GIC supports the initiative by Citigroup and the US government to strengthen the quality of the bank’s capital base in view of the challenging economic environment,’ GIC said in a statement.

Best Credit Card in Hong Kong

I normally use Standard Chartered American Express because they have the best rewards points system. Unfortunately, they have discreetly modified their rewards scheme so they are no longer the best credit card in Hong Kong.

The best card is currently the DBS Black American Express

HK$6 = 1 air mile

followed by the Citibank PremierMiles Visa

HK$8 = 1 air mile

For the air miles rewards scheme, it is better to enrol in Krisflyer than Asiamiles because you need less points under Krisflyer to get an air ticket to Singapore. I think it is 22,500 for Krisflyer compared to 30,000 for Asiamiles.

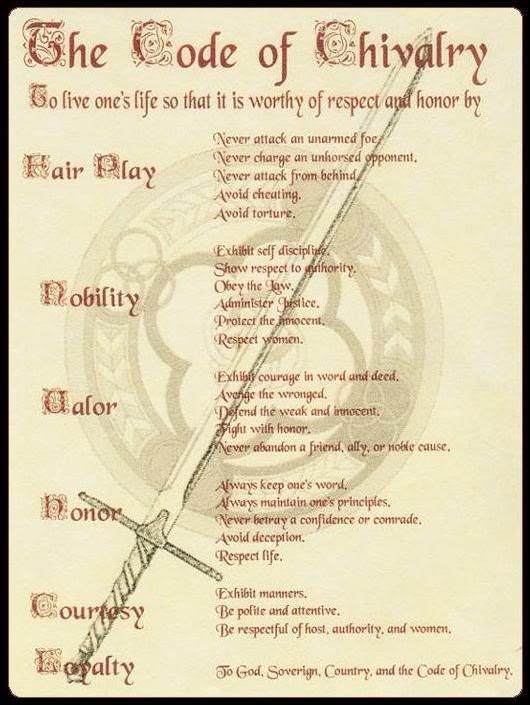

Chivalry

When examining medieval literature, chivalry can be classified into three basic but overlapping areas:

1. Duties to countrymen and fellow Christians: this contains virtues such as mercy, courage, valor, fairness, protection of the weak and the poor, and in the servant-hood of the knight to his lord. This also brings with it the idea of being willing to give one’s life for another’s; whether he would be giving his life for a poor man or his lord.

2. Duties to God: this would contain being faithful to God, protecting the innocent, being faithful to the church, being the champion of good against evil, being generous and obeying God above the feudal lord.

3. Duties to women: this is probably the most familiar aspect of chivalry. This would contain what is often called courtly love, the idea that the knight is to serve a lady, and after her all other ladies. Most especially in this category is a general gentleness and graciousness to all women.

25 Year-Old Beauty Seeks Rich Banker

This was posted on Craigslist last year:

‘What am I doing wrong?

Okay, I’m tired of beating around the bush. I’m a beautiful (spectacularly beautiful) 25 year old girl. I’m articulate and classy. I’m not from New York. I’m looking to get married to a guy who makes at least half a million a year. I know how that sounds, but keep in mind that a million a year is middle class in New York City, so I don’t think I’m overreaching at all.

Are there any guys who make 500K or more on this board ? Any wives ? Could you send me some tips ? I dated a business man who made an average of around 200 – 250K. But that’s where I seem to hit a roadblock. $250,000 won’t get me to Central Park West. I know a woman in my yoga class who was married to an investment banker, and lives in Tribeca. She’s not as pretty as I am, nor is she a great genius. So what is she doing right ? How do I get to her level ?

Here are my questions specifically:

– Where do you single rich men hang out ? Give me specifics – bars, restaurants, gyms

– What are you looking for in a mate? Be honest guys, you won’t hurt my feelings

– Is there an age range I should be targeting ?

– Why are some of the women living lavish lifestyles on the Upper East Side so plain? I’ve seen really ‘Plain Jane’ boring types, who have nothing to offer incredibly wealthy guys. Then I’ve seen drop dead gorgeous girls in singles bars in the East Village. What’s the story there ?

– Lawyers, investment bankers, doctors. How much do those guys really make ? And where do the hedge fund guys hang out ?

– How do you rich guys decide on marriage vs. just a girlfriend ? I am looking for MARRIAGE ONLY.

Please hold your insults – I’m putting myself out there in an honest way. Most beautiful women are superficial – at least I’m being up front about it. I wouldn’t be searching for these kind of guys if I wasn’t able to match them – in looks, culture, sophistication, and keeping a nice hearth and home’.

An Investment Banker’s Response:

Dear Pers-431649184:

‘I read your posting with great interest and have thought meaningfully about your dilemma. I offer the following analysis of your predicament.

Firstly, I’m not wasting your time. I qualify as a guy who fits your bill – that is, I make more than $500K per year. That said, here’s how I see it:

Your offer, from the prospective of a guy like me, is a plain and simple crappy business deal. Here’s why. Cutting through all the B.S., what you suggest is a simple trade: you bring your looks to the party and I bring my money. Fine, simple. But here’s the rub, your looks will fade and my money will likely continue into perpetuity – in fact, it is very likely that my income will increase, but it is an absolute certainty that you won’t be getting any more beautiful!

So, in economic terms, you are a depreciating asset. Not only are you a depreciating asset, however, your depreciation accelerates! Let me explain – you’re 25 now and will likely remain pretty hot for the next 5 years, but less so each year. Then the fade begins in earnest. By 35 – stick a fork in you!

So, in Wall Street terms, we’d call you a trading position – not a buy and hold…hence the rub…marriage. It doesn’t make good business sense to ‘buy you’ (which is what you’re asking) – so I’d rather lease. In case you think I’m being cruel, I would say the following: if my money were to go away, so would you – so when your beauty fades I need an out too. It’s as simple as that. So the deal that makes sense for me is dating, not marriage.

Separately, I was taught early in my career about efficient markets. So, I wonder why a girl as ‘articulate, classy and spectacularly beautiful’ as you has been unable to find your sugar daddy. I find it hard to believe that, if you are as gorgeous as you say you are, your $500K man hasn’t found you – if only for a tryout.

By the way, you could always find a way to make your own money – and then we wouldn’t need to have this difficult conversation.

With all that said, I must say you’re going about it the right way. Classic ‘pump and dump’. I hope this is helpful, and if you want to enter into some sort of lease, please let me know’.