Quote of the Week

“Ultimately there is light and love and intelligence in this universe. And we are it, we carry that within us, it’s not just something out there, it is within us and this is what we are trying to re-connect with, our original light and love and intelligence, which is who we are, so do not get so distracted by all this other stuff, you know, really remember what we are here on this planet for.”

~ Tenzin Palmo

Perfect Reality

“Nothing we see or hear is perfect. But right there in the imperfection is perfect reality.”

~ Shunryu Suzuki

Singapore eyes Malaysia for cheaper living

Singapore eyes Malaysia for cheaper living

Financial Times, 4 Feb 2013

By Jeremy Grant in Singapore

When Tina Ward, a Singaporean mother of two, and her British husband realised they were outgrowing their cramped, government-built apartment in Singapore, they took a gamble.

Instead of trying to find bigger accommodation in the island city-state, the Wards looked across the Singapore Strait to abandoned palm oil plantations on the southern tip of Peninsular Malaysia where land goes for a fraction of what it does on the Singaporean side of the border.

Now, four years later, the family lives in a seven-bedroom mansion with a swimming pool in a community populated by expatriate escapees from Singapore, which is itself just a 30-minute drive away.

“It’s the best decision we made in our lives,” Mrs Ward says.

The Wards were early settlers in Ledang Heights, part of a huge special economic zone called Iskandar that spans a 2,200 sq km area three times the size of Singapore and roughly the size of Luxembourg.

Iskandar is one of over a dozen big-ticket projects under the Malaysian government’s so-called economic transformation programme, designed to help attract higher-value industries and boost foreign investment in the country.

The progress made so far in redeveloping the palm oil plantation is likely to be highlighted by Najib Razak, the country’s prime minister, ahead of a general election due within two months. The prime minister has boasted of his government’s record in attracting inward investment.

The development of new residential and corporate space will also benefit tiny Singapore, where rising costs are hitting some companies and residents hard. Iskandar, said one consultant, could eventually be for Singapore what New Jersey is to New York’s high-cost Manhattan.

Launched in 2006, Iskandar will become a metropolis of 3m people by 2025, policy makers hope, filled with privately funded industry, hospitals, schools and plenty of parks.

They also see Iskandar as a trade and oil storage hub for the Association of Southeast Asian Nations, whose 10 members – including Indonesia, Thailand and Malaysia – are growing rapidly thanks to increasing intraregional commerce.

Such have been the attractions of relatively cheap land in Iskandar that it has not only pulled in new residents like the Wards, but also M$105bn (US$35bn) in cumulative investments as of the end of last November, according to the Iskandar Regional Development Authority, which oversees the project.

“We’ve reached a tipping point,” says its chief executive, Ismail Ibrahim.

Investors include three British universities – Southampton, Newcastle and Reading – which are building campuses as part of an education hub, and the first Legoland theme park in Asia, which opened four months ago.

Investors have been lured by incentives such as a 10-year corporate tax holiday and in the special zone of Medini the waiver of affirmative action preferences that usually require foreign businesses to join with Malay, or so-called bumiputra, partners.

Yet the real long-term outcome of Iskandar could be closer economic relations between Malaysia and Singapore, which split acrimoniously from its neighbour in 1965.

Faced with a shortage of land and rising business costs, companies in Singapore may come under pressure to consider relocating some functions, consultants say.

Till Vestring, managing director in the southeast Asia practice at consultancy Bain, suggests that Iskandar and Singapore could develop a “twinning” concept similar to that between New York’s Manhattan district and neighbouring New Jersey state.

“An advantage over India or the Philippines is that operations in Iskandar can be supervised easily from Singapore and remain tightly integrated,” he says.

That is the sales pitch being used by Global Capital & Development, a company luring developers to Medini and backed by Mubadala, Abu Dhabi’s sovereign wealth fund, and its Malaysian counterpart, Khazanah.

Keith Martin, chief executive of GC&D, says: “Singapore actually gets a double benefit because its gets the value-added business of having companies headquarter there, but the support space they get in Medini will free up more land in Singapore for more high value-added businesses.”

Critics of Iskandar say that the project has developed in sometimes piecemeal fashion with ambitious announcements that fall short in the execution. Visitors to the site drive along stretches of road flanked with empty land awaiting development.

In addition, local politicians warn that the region’s predominantly Malay population is being economically marginalised by a flood of investment that has inflated property prices.

Nur Jazlan Mohamed is a member of parliament representing the United National Malays Organisation – the dominant party in Mr Najib’s governing Barisan Nasional coalition – in the state of Johor.

He says he has reservations about the project: “Everyone’s suffering as prices are beyond the median incomes of people here. There were a lot of incentives given to foreign investors but there has to be a balance.”

Temasek, Singapore’s state investment agency, and Khazanah in 2011 agreed jointly to develop a residential and commercial property project in Iskandar which both believe will be worth M$3bn on completion.

“Iskandar represents the most concerted effort by both countries to have some sort of loose economic co-operation,” says Eugene Tan, assistant professor of law at Singapore Management University. “It’s still very early days, but it is a window of opportunity for both.”

This article has been amended to reflect that Temasek and Khazanah agreed in 2011 jointly to develop projects in Iskandar which both believe will be valued at M$3bn when completed, not that both will invest S$11bn in the projects as incorrectly stated previously.

Cloud Atlas

Our lives are not our own, we are bound to others, past and present. And by each crime and every kindness, we birth our future.

The greedy, giddy days of HK tycoons

Now, barriers to elite circle is higher, says author who offers an insider look at taipans

ST Feb 03, 2013

A 1995 picture of the Suntec City board in a book by Mr Robert Wang (back row, third from left). The board included tycoons (front, from left) Chou Wen Hsien, Lee Shau Kee, Run Run Shaw, Frank Tsao, Li Ka Shing and Cheng Yu Tung. — PHOTO: ROBERT WANG

By Li Xueying, Hong Kong Correspondent In Hong Kong

Along-held belief in Asia’s bastion of capitalism – that “greed is good” – is fast crumbling, says a man who for much of his life abided by this axiom as he strove to get rich.

“Hong Kongers are resenting that attitude now,” says lawyer-turned-businessman Robert Wang, not least because they feel they no longer have the opportunities to become rich the way the present elite did.

He should know. After all, in the giddy, greedy days of the 1980s and 1990s, the 68-year-old rubbed shoulders with Hong Kong’s richest men.

“It’s more difficult to become a tycoon today,” observes Mr Wang, referring to the “clannish” networks, cartels and other formidable entry barriers in high-yield industries like property.

And as the income gap widens further, this sense of impotence is fuelling “greater dissatisfaction and social unrest”.

“The opportunities are not there any more,” Mr Wang said in a recent interview. “I feel sorry for my children, let alone my grandchildren.”

The golden era of the past is captured colourfully in Mr Wang’s autobiography published last year. As he wrote: “Nothing is impossible in capitalistic Hong Kong. The important thing is to get on track. Anyone can then be launched into the orbit of tycoons, me included.”

Mr Wang was five when his family fled Shanghai after the communist takeover and headed to Hong Kong, a British colony at the time. Decades later, he was part of the gilded circle – only to be kicked out unceremoniously later.

His book in English, Walking The Tycoons’ Rope, is an insider look at the cut-throat world of Hong Kong tycoons – known here as taipans – and Mr Wang’s interactions with them. It also describes his meetings with some Singapore leaders – Mr Lee Kuan Yew, Dr Goh Keng Swee and then president Ong Teng Cheong.

There are colourful details of so-called Shanghai parties, where tycoons hook up with starlets, the mood swings of Asia’s richest man, the mercurial Li Ka Shing, snarky remarks feuding tycoons made about each other, as well as intimacies that powerful men shared.

For instance, Mr Wang recounts Mr Ong’s lament about the cancer that plagued both him and his wife – “we both live so simply and healthily it boggles my mind even to think about how we can both end up with cancer”.

Mr Wang also describes how he got on the inside track into elite circles in Hong Kong and Singapore.

In the run-up to Hong Kong’s 1997 handover, he petitioned MrLee to allow Hong Kong lawyers and entrepreneurs – all jittery about the city’s prospects under China’s rule – to have residential rights in Singapore.

Mr Wang recalls Mr Lee, who was not convinced that their fears would materialise, asking: “Why are you worried? What can be the consternation?”

But after a “gruelling” cross-examination lasting over an hour, MrLee agreed to the plan, telling MrWang: “I am willing to offer them (Hong Kongers) a bolt-hole. An unstable Hong Kong is not in our interests.”

In the end, Mr Lee was proven right – the handover went smoothly and most of those who signed up for the Singapore schemes remained in Hong Kong.

But having this option at the time, says Mr Wang, helped allay the fears of many who would have fled to faraway countries like Canada.

It also had the longer-term effect of “helping create an awareness of opportunities in Singapore among the Hong Kong tycoons”, many of whom thought that government-linked companies had a strong grip on the economy, making competition tough.

One immediate result was the creation of the Suntec group in 1985, whose 21 shareholders – among them property tycoons Li, Lee Shau Kee and Cheng Yu Tung, and entertainment mogul Run Run Shaw – invested in the building of Suntec City and its convention centre. Together, the shareholders held 40 per cent of Hong Kong’s market capitalisation.

Suntec City grew to a size not seen among Singapore malls at that point, attracting choice remarks from people such as Singapore businessman Ong Beng Seng, Mr Wang recalls in the book.

“When you have so much money, you just want to erect the biggest and tallest monument to immortalise yourself, as if it is going to be your last erection,” Mr Ong reportedly said.

As the spokesman and a director for Suntec, Mr Wang had a ringside seat to the rivalry between Mr Li Ka Shing and Mr Lee Shau Kee, both vying to be Hong Kong’s richest man.

“At times they were at each other’s throats,” Mr Wang wrote. “However, in business as in politics, there are no permanent enemies or friends. It depends on what serves the interest of the party at any given point.”

Mr Wang admitted he also sought to get rich by taking “the route all tycoons take to become who they are – you use OPM (other people’s money) to grow MOM (my own money)”.

But he overreached and got caught in the crossfire between the feuding tycoons, who would dispense with his services.

In Singapore, he offended banker Wee Cho Yaw over the sale of shares in a joint venture and also Old Guard leader Lim Kim San whose name was listed as a governor for a new club without his permission. The Singapore Hong Kong Club, Mr Wang had hoped, would be a platform for the two cities’ elites to meet, exchange ideas and perhaps invest together. Its launch was cancelled and Mr Wang left Singapore “in disgrace” for Hong Kong, where he continues today to tap his connections for business opportunities.

Looking back, Mr Wang muses over what was “a rich and exciting life” looking for and seizing opportunities, which he has captured in a book “for posterity”. The book, which has sold out its first print run of 3,000 copies, is now in its second edition.

But Mr Wang is worried that stagnating mobility and the widening income gap will make it difficult “to produce another Li Ka Shing”, who started out as a salesman.

In today’s Hong Kong, the rich can consolidate their wealth by simply “sitting back and collecting rent”. This sparks “great anger” from the masses, which then forces the government to distribute resources more fairly. Meanwhile, tycoons “fight to protect what they have”.

“It’s not a rosy picture,” says MrWang of the road ahead.

Armin van Buuren feat. Laura V – Drowning (Avicii Remix)

The Blizzard & Yuri Kane feat. Relyk – Everything About You (Original Mix)

Dj Tiesto – Bright Morningstar

This song transports me to another time, another place, another memory. Ah the memories… Enjoy!

Ronski Speed ft. Melissa Loretta – Sanity

Tao Te Ching

He who knows others is wise.

He who knows himself is illuminated.

He who defeats others is strong.

He who defeats himself is powerful.

He who knows happiness is rich.

He who keeps his path is wilful.

Be humble and you will become whole.

Bend and you will become straight.

Empty yourself and you will become full.

Wear yourself out and you will become new.

The wise man does not show off, and so he shines.

He does not make himself known, and so he is noticed.

He does not praise himself, and so he has merit.

And because he does not compete,

none in the world can compete with him.

Aknael & Bekeela feat Jane Maximova – Your Love (Original Mix) HD

Quote of the Week

“What could I say to you that would be of value, except that perhaps you seek too much, that as a result of your seeking you cannot find.”

~ Hermann Hesse, Siddhartha

Sunlounger – White Sand (Dj Shah’s Original Mix)

Singapore hikers lost for 15 hours in Kota Tinggi

S’pore hikers lost for 15 hours in Kota Tinggi

8 spent night on slope after wrong turn; call to cabby led to police search

Nov 13, 2012

By Priscilla Goy And Pearl Lee

A WRONG turn left eight Singaporeans stranded in a forest reserve near a Kota Tinggi waterfall for more than 15 hours over the weekend. They were finally rescued at about 10am on Sunday – wet and exhausted after spending the night on a slope and in utter darkness.

The eight trekkers were Ms Tay Wei Xin, 25, Mr Law Teck Chuan, 28, Mr Lim Pong Hui, 27, Mr Wong Thiam Siang, 28, Ms Seow Pei Wen, 25, Ms Xiao Yulin, 25, and siblings Sng Yu Xin, 21, and Sng Ping Qiu, 28.

Ms Tay, Ms Seow and Ms Xiao had trekked in Kota Tinggi, about two hours’ drive from Singapore, a few times before, while the rest were doing so for the first time.

Ms Tay, a teacher, said the group, who are all friends of either Ms Sng or Mr Sng, checked into Kota Tinggi Waterfalls Resort at about 10.30am on Saturday. They had taken a bus across the Causeway, then a taxi to the hotel. They had intended to stay for the weekend. They set off for the Pelepah waterfalls in the Gunung Panti recreational forest at about 11am. The trek was within walking distance of their resort. She said she told the receptionist at the hotel of their trek.

Mr Sng, an application developer, said they had planned to hike upslope, which would take them past the three waterfalls there, and then backtrack to the resort. The end of the trail would be marked by the third waterfall. At about 4.30pm, they came to a point where there were two markers, which are pieces of ribbon or plastic tied around tree trunks by previous hikers. One led to the left, another to the right. Said Ms Tay: “We took the left turn because it led downstream, but after about five to 10 minutes, we realised it led nowhere. There were no more markers.”

The group went back and took the right turn, but realised they were walking in circles. They stopped at about 7pm as it was getting dark. They considered waiting till morning before continuing their trek back, but decided to call the police.

“It was getting very dangerous to walk, and the trail was also very steep and narrow,” said Mr Sng. “We had to walk one by one… we couldn’t go in twos. One person had to stay at the back to flash the torchlight on the trail because it was too dark.” Ms Sng was also having a fever by then.

Mr Sng had saved the mobile number of the Malaysian taxi driver who drove them to the hotel from the Kota Tinggi bus terminal. He called the taxi driver, who alerted the Malaysian police.

Ms Tay said that at 10.30pm, the police called them to say that they would be searching for them. The group waited till about 2am on Sunday, but no one came for them. “We had water, we had food, we just did not have extra clothing,” said Ms Tay. They had between them a loaf of bread, some crackers and sweets – leftovers from the food they had packed for their picnic. Ms Tay, who was wearing two T-shirts, offered one to Ms Sng, who was feeling cold because of her fever. The rest of the group hugged their legs while sitting down to keep themselves warm.

At about 7am, the police called them to say officers would be going upstream to search for them.

When Mr Law went downstream to look out for the rescue team, he saw a villager fishing by the river. He blew a whistle he had with him to attract the villager’s attention. The villager led the trekkers out of the Pelepah falls area to the route that would take them back to their resort. They met their rescuers along the way, said Ms Tay.

The group took a bus back to Singapore later on Sunday.

Asked how they would trek differently in future, Ms Tay said: “I will bring a windbreaker, a lighter, maybe some things to light a fire.” Mr Sng said that although it was unpleasant to have been stranded, he was still up for another trek. “But this time, with a guide definitely,” he said.

The New Straits Times yesterday quoted Kota Tinggi district police chief Che Mahazan Che Aik as advising foreigners who want to trek in the area to alert the hotel operator before setting out or hire a local guide.

Quote of the Week

“We’re so self-important. So arrogant. Everybody’s going to save something now. Save the trees, save the bees, save the whales, save the snails. And the supreme arrogance? Save the planet! Are these people kidding? Save the planet? We don’t even know how to take care of ourselves; we haven’t learned how to care for one another. We’re gonna save the fuckin’ planet? . . . And, by the way, there’s nothing wrong with the planet in the first place. The planet is fine. The people are fucked! Compared with the people, the planet is doin’ great. It’s been here over four billion years . . . The planet isn’t goin’ anywhere, folks. We are! We’re goin’ away. Pack your shit, we’re goin’ away. And we won’t leave much of a trace. Thank God for that. Nothing left. Maybe a little Styrofoam. The planet will be here, and we’ll be gone. Another failed mutation; another closed-end biological mistake.”

― George Carlin

Quote of the Week

“The most beautiful people we have known are those who have known defeat, known suffering, known struggle, known loss, and have found their way out of the depths. These persons have an appreciation, a sensitivity, and an understanding of life that fills them with compassion, gentleness, and a deep loving concern. Beautiful people do not just happen.”

~ Elisabeth Kübler-Ross (1926 – 2004)

The Hours

“We throw our parties; we abandon our families to live alone in Canada; we struggle to write books that do not change the world, despite our gifts and our unstinting efforts, our most extravagant hopes. We live our lives, do whatever we do, and then we sleep. It’s as simple and ordinary as that. A few jump out windows, or drown themselves, or take pills; more die by accident; and most of us are slowly devoured by some disease, or, if we’re very fortunate, by time itself. There’s just this for consolation: an hour here or there when our lives seem, against all odds and expectations, to burst open and give us everything we’ve ever imagined, though everyone but children (and perhaps even they) know these hours will inevitably be followed by others, far darker and more difficult. Still, we cherish the city, the morning; we hope, more than anything, for more. Heaven only knows why we love it so…”

~ Michael Cunningham, The Hours

In memory of Dr Richard Teo who finished his race

Below is the transcript of the talk of Dr. Richard Teo, who is a 40-year-old millionaire and cosmetic surgeon with a stage-4 lung cancer but selflessly came to share with the D1 class his life experience on 19-Jan-2012.

Hi good morning to all of you.

My voice is a bit hoarse, so please bear with me. I thought I’ll just introduce myself. My name is Richard, I’m a medical doctor. And I thought I’ll just share some thoughts of my life. It’s my pleasure to be invited by prof. Hopefully, it can get you thinking about how… as you pursue this.. embarking on your training to become dental surgeons, to think about other things as well.

Since young, I am a typical product of today’s society. Relatively successful product that society requires.. From young, I came from a below average family. I was told by the media… and people around me that happiness is about success. And that success is about being wealthy. With this mind-set, I’ve always be extremely competitive, since I was young.

Not only do I need to go to the top school, I need to have success in all fields. Uniform groups, track, everything. I needed to get trophies, needed to be successful, I needed to have colours award, national colours award, everything. So I was highly competitive since young. I went on to medical school, graduated as a doctor. Some of you may know that within the medical faculty, ophthalmology is one of the most highly sought after specialities. So I went after that as well. I was given a traineeship in ophthalmology, I was also given a research scholarship by NUS to develop lasers to treat the eye.

So in the process, I was given 2 patents, one for the medical devices, and another for the lasers. And you know what, all this academic achievements did not bring me any wealth. So once I completed my bond with MOH, I decided that this is taking too long, the training in eye surgery is just taking too long. And there’s lots of money to be made in the private sector. If you’re aware, in the last few years, there is this rise in aesthetic medicine. Tons of money to be made there. So I decided, well, enough of staying in institution, it’s time to leave. So I quit my training halfway and I went on to set up my aesthetic clinic… in town, together with a day surgery centre.

You know the irony is that people do not make heroes out average GP (general practitioner), family physicians. They don’t. They make heroes out of people who are rich and famous. People who are not happy to pay $20 to see a GP, the same person have no qualms paying ten thousand dollars for a liposuction, 15 thousand dollars for a breast augmentation, and so on and so forth. So it’s a no brainer isn’t? Why do you want to be a gp? Become an aesthetic physician. So instead of healing the sick and ill, I decided that I’ll become a glorified beautician. So, business was good, very good. It started off with waiting of one week, then became 3weeks, then one month, then 2 months, then 3 months. I was overwhelmed; there were just too many patients. Vanities are fantastic business. I employed one doctor, the second doctor, the 3rd doctor, the 4th doctor. And within the 1st year, we’re already raking in millions. Just the 1st year. But never is enough because I was so obsessed with it. I started to expand into Indonesia to get all the rich Indonesian tai-tais who wouldn’t blink an eye to have a procedure done. So life was really good.

So what do I do with the spare cash. How do I spend my weekends? Typically, I’ll have car club gatherings. I take out my track car, with spare cash I got myself a track car. We have car club gatherings. We’ll go up to Sepang in Malaysia. We’ll go for car racing. And it was my life. With other spare cash, what do i do? I get myself a Ferrari. At that time, the 458 wasn’t out, it’s just a spider convertible, 430. This is a friend of mine, a schoolmate who is a forex trader, a banker. So he got a red one, he was wanting all along a red one, I was getting the silver one.

So what do I do after getting a car? It’s time to buy a house, to build our own bungalows. So we go around looking for a land to build our own bungalows, we went around hunting. So how do i live my life? Well, we all think we have to mix around with the rich and famous. This is one of the Miss Universe. So we hang around with the beautiful, rich and famous. This by the way is an internet founder. So this is how we spend our lives, with dining and all the restaurants and Michelin Chefs you know.

So I reach a point in life that I got everything for my life. I was at the pinnacle of my career and all. That’s me one year ago in the gym and I thought I was like, having everything under control and reaching the pinnacle.

Well, I was wrong. I didn’t have everything under control. About last year March, I started to develop backache in the middle of nowhere. I thought maybe it was all the heavy squats I was doing. So I went to SGH, saw my classmate to do an MRI, to make sure it’s not a slipped disc or anything. And that evening, he called me up and said that we found bone marrow replacement in your spine. I said, sorry what does that mean? I mean I know what it means, but I couldn’t accept that. I was like “Are you serious?” I was still running around going to the gym you know. But we had more scans the next day, PET scans – positrons emission scans, they found that actually I have stage 4 terminal lung cancer. I was like “Whoa where did that come from?” It has already spread to the brain, the spine, the liver and the adrenals. And you know one moment I was there, totally thinking that I have everything under control, thinking that I’ve reached the pinnacle of my life. But the next moment, I have just lost it.

This is a CT scan of the lungs itself. If you look at it, every single dot there is a tumour. We call this miliaries tumour. And in fact, I have tens of thousands of them in the lungs. So, I was told that even with chemotherapy, that I’ll have about 3-4months at most. Did my life come crushing on, of course it did, who wouldn’t? I went into depression, of course, severe depression and I thought I had everything.

See the irony is that all these things that I have, the success, the trophies, my cars, my house and all. I thought that brought me happiness. But i was feeling really down, having severe depression. Having all these thoughts of my possessions, they brought me no joy. The thought of… You know, I can hug my Ferrari to sleep, no… No, it is not going to happen. It brought not a single comfort during my last ten months. And I thought they were, but they were not true happiness. But it wasn’t. What really brought me joy in the last ten months was interaction with people, my loved ones, friends, people who genuinely care about me, they laugh and cry with me, and they are able to identify the pain and suffering I was going through. That brought joy to me, happiness. None of the things I have, all the possessions, and I thought those were supposed to bring me happiness. But it didn’t, because if it did, I would have felt happy think about it, when I was feeling most down..

You know the classical Chinese New Year that is coming up. In the past, what do I do? Well, I will usually drive my flashy car to do my rounds, visit my relatives, to show it off to my friends. And I thought that was joy, you know. I thought that was really joy. But do you really think that my relatives and friends, whom some of them have difficulty trying to make ends meet, that will truly share the joy with me? Seeing me driving my flashy car and showing off to them? No, no way. They won’t be sharing joy with me. They were having problems trying to make ends meet, taking public transport. In fact i think, what I have done is more like you know, making them envious, jealous of all I have. In fact, sometimes even hatred.

Those are what we call objects of envy. I have them, I show them off to them and I feel it can fill my own pride and ego. That didn’t bring any joy to these people, to my friends and relatives, and I thought they were real joy.

Well, let me just share another story with you. You know when I was about your age, I stayed in king Edward VII hall. I had this friend whom I thought was strange. Her name is Jennifer, we’re still good friends. And as I walk along the path, she would, if she sees a snail, she would actually pick up the snail and put it along the grass patch. I was like why do you need to do that? Why dirty your hands? It’s just a snail. The truth is she could feel for the snail. The thought of being crushed to death is real to her, but to me it’s just a snail. If you can’t get out of the pathway of humans then you deserve to be crushed, it’s part of evolution isn’t it? What an irony isn’t it?

There I was being trained as a doctor, to be compassionate, to be able to empathise; but I couldn’t. As a house officer, I graduated from medical school, posted to the oncology department at NUH. And, every day, every other day I witness death in the cancer department. When I see how they suffered, I see all the pain they went through. I see all the morphine they have to press every few minutes just to relieve their pain. I see them struggling with their oxygen breathing their last breath and all. But it was just a job. When I went to clinic every day, to the wards every day, take blood, give the medication but was the patient real to me? They weren’t real to me. It was just a job, I do it, I get out of the ward, I can’t wait to get home, I do my own stuff.

Was the pain, was the suffering the patients went through real? No. Of course I know all the medical terms to describe how they feel, all the suffering they went through. But in truth, I did not know how they feel, not until I became a patient. It is until now; I truly understand how they feel. And, if you ask me, would I have been a very different doctor if I were to re-live my life now, I can tell you yes I will. Because I truly understand how the patients feel now. And sometimes, you have to learn it the hard way.

Even as you start just your first year, and you embark this journey to become dental surgeons, let me just challenge you on two fronts.

Inevitably, all of you here will start to go into private practice. You will start to accumulate wealth. I can guarantee you. Just doing an implant can bring you thousands of dollars, it’s fantastic money. And actually there is nothing wrong with being successful, with being rich or wealthy, absolutely nothing wrong. The only trouble is that a lot of us like myself couldn’t handle it.

Why do I say that? Because when I start to accumulate, the more I have, the more I want. The more I wanted, the more obsessed I became. Like what I showed you earlier on, all I can was basically to get more possessions, to reach the pinnacle of what society did to us, of what society wants us to be. I became so obsessed that nothing else really mattered to me. Patients were just a source of income, and I tried to squeeze every single cent out of these patients.

A lot of times we forget, whom we are supposed to be serving. We become so lost that we serve nobody else but just ourselves. That was what happened to me. Whether it is in the medical, the dental fraternity, I can tell you, right now in the private practice, sometimes we just advise patients on treatment that is not indicated. Grey areas. And even though it is not necessary, we kind of advocate it. Even at this point, I know who are my friends and who genuinely cared for me and who are the ones who try to make money out of me by selling me “hope”. We kind of lose our moral compass along the way. Because we just want to make money.

Worse, I can tell you, over the last few years, we bad mouth our fellow colleagues, our fellow competitors in the industry. We have no qualms about it. So if we can put them down to give ourselves an advantage, we do it. And that’s what happening right now, medical, dental everywhere. My challenge to you is not to lose that moral compass. I learnt it the hard way, I hope you don’t ever have to do it.

Secondly, a lot of us will start to get numb to our patients as we start to practise. Whether is it government hospitals, private practice, I can tell you when I was in the hospital, with stacks of patient folders, I can’t wait to get rid of those folders as soon as possible; I can’t wait to get patients out of my consultation room as soon as possible because there is just so many, and that’s a reality. Because it becomes a job, a very routine job. And this is just part of it. Do I truly know how the patient feels back then? No, I don’t. The fears and anxiety and all, do I truly understand what they are going through? I don’t, not until when this happens to me and I think that is one of the biggest flaws in our system.

We’re being trained to be healthcare providers, professional, and all and yet we don’t know how exactly they feel. I’m not asking you to get involved emotionally, I don’t think that is professional but do we actually make a real effort to understand their pain and all? Most of us won’t, alright, I can assure you. So don’t lose it, my challenge to you is to always be able to put yourself in your patient’s shoes.

Because the pain, the anxiety, the fear are very real even though it’s not real to you, it’s real to them. So don’t lose it and you know, right now I’m in the midst of my 5th cycle of my chemotherapy. I can tell you it’s a terrible feeling. Chemotherapy is one of those things that you don’t wish even your enemies to go through because it’s just suffering, lousy feeling, throwing out, you don’t even know if you can retain your meals or not. Terrible feeling! And even with whatever little energy now I have, I try to reach out to other cancer patients because I truly understand what pain and suffering is like. But it’s kind of little too late and too little.

You guys have a bright future ahead of you with all the resource and energy, so I’m going to challenge you to go beyond your immediate patients. To understand that there are people out there who are truly in pain, truly in hardship. Don’t get the idea that only poor people suffer. It is not true. A lot of these poor people do not have much in the first place, they are easily contented. for all you know they are happier than you and me but there are out there, people who are suffering mentally, physically, hardship, emotionally, financially and so on and so forth, and they are real. We choose to ignore them or we just don’t want to know that they exist.

So do think about it alright, even as you go on to become professionals and dental surgeons and all. That you can reach out to these people who are in need. Whatever you do can make a large difference to them. I’m now at the receiving end so I know how it feels, someone who genuinely care for you, encourage and all. It makes a lot of difference to me. That’s what happens after treatment. I had a treatment recently, but I’ll leave this for another day. A lot of things happened along the way, that’s why I am still able to talk to you today.

I’ll just end of with this quote here, it’s from this book called Tuesdays with Morris, and some of you may have read it. Everyone knows that they are going to die; every one of us knows that. The truth is, none of us believe it because if we did, we will do things differently. When I faced death, when I had to, I stripped myself off all stuff totally and I focused only on what is essential. The irony is that a lot of times, only when we learn how to die then we learn how to live. I know it sounds very morbid for this morning but it’s the truth, this is what I’m going through.

Don’t let society tell you how to live. Don’t let the media tell you what you’re supposed to do. Those things happened to me. And I led this life thinking that these are going to bring me happiness. I hope that you will think about it and decide for yourself how you want to live your own life. Not according to what other people tell you to do, and you have to decide whether you want to serve yourself, whether you are going to make a difference in somebody else’s life. Because true happiness doesn’t come from serving yourself. I thought it was but it didn’t turn out that way. With that I thank you, if you have any questions you have for me, please feel free. Thank you.

Quote of the Week

“Religion has convinced people that there’s an invisible man … living in the sky. Who watches everything you do every minute of every day. And the invisible man has a list of ten specific things he doesn’t want you to do.

And if you do any of these things, he will send you to a special place, of burning and fire and smoke and torture and anguish for you to live forever, and suffer, and suffer, and burn, and scream, until the end of time.

But he loves you. He loves you. He loves you and he needs money.”

~ George Carlin

Quote of the Week

“What are you waiting for?

You’re faster than this.

Don’t think you are, know you are.

Come on.

Stop trying to hit me and hit me.”

~ Morpheus

Ellie Goulding – Lights

Elena Jane “Ellie” Goulding (born 30 December 1986) is an English singer-songwriter. She released her debut studio album, Lights, in 2010. The album debuted at number one on the UK Albums Chart and has sold over 850,000 copies in the UK. The album’s title track, “Lights”, was released in the US in March 2011, and reached its peak position of number two on the Billboard Hot 100 nearly a year and a half later during its thirty-third week charting, completing one of the longest ever climbs into the top two positions on the chart. The single was also certified triple platinum by the RIAA.

Mono no aware (物の哀れ)

Mono no aware (物の哀れ), literally “the pathos of things”, and also translated as “an empathy toward things”, or “a sensitivity to ephemera”, is a Japanese term used to describe the awareness of impermanence (無常 mujō), or transience of things, and a gentle sadness (or wistfulness) at their passing.

The word is derived from the Japanese word mono (物), which means “thing”, and aware (哀れ), which was a Heian period expression of measured surprise (similar to “ah” or “oh”), translating roughly as “pathos”, “poignancy”, “deep feeling”, or “sensitivity”, or “aware”. Thus, mono no aware has frequently been translated as “the ‘ahh-ness’ of things”, life, and love. Awareness of the transience of all things heightens appreciation of their beauty, and evokes a gentle sadness at their passing.

One Silversea, Hong Kong, where I used to live in 2010-2011

Markus Schulz feat. Seri – Love Rain Down (Official Music Video)

Flo Rida – Wild Ones ft. Sia

Sia Kate Isobelle Furler (born 18 December 1975), better known as Sia, is an Australian downtempo, pop, and jazz singer and songwriter. She is vegetarian and participated in an advertisement with her dog Pantera, for PETA Asia-Pacific to encourage pet neutering.

In June 2010, Furler’s official website announced that all scheduled promotional events and shows had been cancelled due to her poor health. She cited extreme lethargy and panic attacks and considered retiring permanently from performing and touring. According to her Twitter account she was diagnosed with Graves’ disease – an autoimmune disorder with an over-active thyroid. Four months later, in an ARIA Awards interview Furler said her health was improving after rest and thyroid hormone replacement therapy. Furler has said she will release an album in the summer of 2012 and will refrain from touring temporarily.

Magic

“Those who don’t believe in magic will never find it.”

~ Roald Dahl

Cedele by Bakery Depot

Interview with Ms. Yeap Cheng Guat, Founder of Cedele By Bakery Depot

by Teo Sok Huang on 28-May-2009

Founded in July 1997 and with the establishment of the brand name Cedele in 1999, this home-grown chain has expanded to 17 stores comprising of bakery cafes, bakeries and all-day dining restaurants. Bakery Depot has been advocating positive eating, attitude and healthy food, made responsibly and with great passion by artisan bakers. With its philosophy of “Eat Well, Be Well”, Bakery Depot has been creating nutritious and wholesome food, handmade from scratch with fresh and natural quality ingredients, without any unhealthy preservatives, trans fat or additives. The company has garnered numerous positive reviews from the media and public.

Interviewer’s Comments:

Ms. Yeap appeared sincere and self-confident throughout the interview. One can see her passion and enthusiasm in providing food of the best quality for the better health of her customers and the environment. Ms. Yeap was candid with how her previous working experience, family life and personal thinking have structured her business philosophy. Her dedication towards her company was evident, as she discussed her plans to further innovate and expand the business in Singapore and overseas. Ms. Yeap wants to take the lead in educating consumers on what good food is, and generating the interests of consumers in what goes into their food and how their food is made.

1. What is the nature of your business?

Bakery Depot started out as a bakery, which will always be the backbone of our business. Additionally, we bake for wholesale business. When we launched the Cedele brand, our proposition was to serve healthful meals. We offer a wide variety of wholesome, sugar- and fat-free freshly baked breads and have up to 8 different types of breads daily for our signature gourmet sandwiches. We were also the first to offer soups and salads made from scratch, which was like an innovation back then. Our vegetarian and meat-based soups are so hearty that most people would find that one bowl is sufficient. Our food has absolutely no trans fat and Cedele was the first in the market to introduce organic unrefined sugar in our cakes, pies, pastries and cookies. To date, we have 17 stores comprising of retail bakery, bakery cafe and all day dining restaurants. We are happy that we have provided an avenue for people to be given a choice to eat better.

2. When and why did you decide to become an entrepreneur / take over your family business? NOTE: If it is not a family business, ask: Do your parents have their own businesses too? Have they inspired you in one way or another? (Select appropriate question according to the entrepreneur being interviewed.)

I decided to be an entrepreneur as I want to make a difference and be free to express myself through my work. I also want to advocate healthy food and positive eating. My parents did have their own business but it is totally different from mine. Education was a priority in our family. My parents worked hard to ensure that their children received an education so that we can make a difference in our lives. My parents taught me virtue, life values, integrity and the value of education.

3. What are your reasons for choosing to do business in this particular industry?

The barrier to entry into the baking business was low. Also, baking is something that I have always done. Cooking and baking are very therapeutic and come as a second nature to me. So I went for cooking lessons and trained. Besides, I have an academic background and am strong in research, so I was confident that I could survive in the business.

4. How did you put together all the resources needed to start your business? For example: getting the start-up capital, hiring staff, doing sales and marketing, advertising, etc.

I try to hire people who are new to the business as they would not have any preconceptions. Also, you must first understand where you are now and what your business format is. I chose the appropriate marketing vehicle based on my budget and an understanding of where my business is. For example, television commercials may not be the best medium for a niche business like Cedele. It is better to find a medium that is more engaging and therefore, we have a website. In my first shop, I provided samples of our food for customers to try. I realized that sampling was one of the best ways to market my business, and calculated that it was cheaper than putting up an advertisement. We then built our customer base by introducing loyalty programmes such as loyalty cards or discounts. Communication is key and we implemented in-store communications posters and leaflets. Some of my thoughts or quotes even ended up on the blackboards in the stores! It is important to be newsworthy and have the press write about us. It is more credible for a third party to talk about us and this free publicity is a powerful vehicle for the public to learn about Cedele. We will also work with other organizations with the same ethos as us for joint promotions to further build the Cedele brand.

5. How did you go about designing the process? Did you have much knowledge regarding this industry when you first started?

I did not really have much knowledge about the F&B industry. I worked in real estate and telecommunications industries before. It was from an FMCG (fast-moving consumer group) multinational company that I learned a lot about business processes. I can resonate with the working style of an FMCG business. Thus I am very process-driven and would inject this discipline into my own business. Being in an FMCG company helped me understand and identify gaps in the market. For example, I noticed that people had to pay a lot for wholemeal bread and only selected groups could afford to buy. Thus I started a bakery business to make wholesome healthy breads more accessible to the public and sold at a reasonable price.

6. I am rather curious, why did you choose the name Cedele?

We started as Bakery Depot, which was essentially a bakery. When we first opened downtown, we decided to serve drinks and meals, alongside our breads, cakes and pastries. However people thought Bakery Depot was just a bakery and it would not be the first place in mind to go to for lunch. Hence we decided to use a different name – Cedele. It represents our retail brand. It does not have any apparent meaning but just sounds like Deli. We had to put a meaning to the Cedele brand in the initial years, as there was quite a lot of press already written about Bakery Depot. After 10 years of building the Cedele brand, landlords recognize and are comfortable with the brand. For the past few years, we have been positioning Cedele on a foothold emphasizing health, hence our “Eat Well, Be Well” proposition.

7. What are some interesting stories you have about your first few customers / first few years in business?

5 years ago, I met a couple who goes to our Frankel Avenue store every weekend. The husband liked to eat cakes and breads but could not as he was diabetic. I created a sugarless cake for him. He also inspired me to do a higher-percentage wholemeal bread and we now have a 100% wholemeal range. I think it is important to know what the customer needs. If a customer has special dietary needs due to medical reasons, we will try to provide a solution if we can at Cedele. Many years ago, I had a customer whose 12-year-old daughter was a recovering cancer patient and had not eaten a birthday cake for 6 years. I made her first birthday cake – a banana-bread cake – where I eliminated the sugar and ripened the bananas. She was so happy! She now regularly buys sugar-free cakes from Cedele. It makes me smile to be able to find happy solutions for my customers.

8. What were some of the challenges you faced when you first went into business?

One of the challenges would be getting the ingredients that we want. It was hard to get people to understand what I am doing, my philosophy and approach to creating and making food. I had peers in the industry who told me that I would fail and it was challenging to get bakers to work for me. For example, my bread recipes exclude fats and sugar.This was against the norm and many bakers did not believe that I could do it.

9. How did you overcome these challenges? Please share some specific examples of the action you took to overcome the challenges.

I did it the hard way by starting from scratch and training my people. I utilized my skills learnt whilst working in the MNCs which were useful in helping me to train my people effectively. I had to let my first baker go after 4 weeks into business as he would want to order improvers, which I do not allow. I also hired a junior baker, who was a cook but knew nothing about baking. Through training and mentoring, he is still with me today.

10. Can you remember your worst day in business or a time when you felt like giving up? What happened that made you feel that way and how did you triumph over it?

People do let me down, such as suppliers and stakeholders in the company. At times, we were unsuccessful in influencing certain people to join our organization or new workers from doing the opposite of what we want. I do get frustrated and start to question whether I should take the easy way out. However, I have never succumbed to such temptations and am clear of what I should do. I rethink how we should improve the shortlisting process and hire different groups of people. The solution is to hire the un-norm people, who have not worked in this industry, to fit into this un-norm business of ours.

11. What are some of your proudest business achievements to date? And why are they so important and meaningful to you?

I believe that it is the journey, rather than a fixed moment, that you can be proud of. Nevertheless, I did feel proud when I recently saw a local bakery truck carrying a label that said “No trans fat”. Years ago, Cedele was one of the first to introduce food with no trans fat, so I felt that I have made a shift by creating awareness and fighting against trans fat. You look back at your achievements, after a period of time in which you try to do the positive and right thing, and you see what has been the impact. Therefore another proud moment would be looking at how some of my staff have grown to be different and better persons compared to the day they first joined us.

12. How do you differentiate your business from your competitors? Please provide specific examples.

Cedele stands out from other cafe / restaurant operators because of our “Eat Well, Be Well” positioning and we translate this philosophy into creating and making of our food. We differentiate ourselves based on how and when we cook our food, how we buy the ingredients and how long they are kept. We continuously pay attention to our product quality and presentation, such that when a customer comes to Cedele, he knows that he will get a great deal, not of a low price but of quality and taste. Customers can be assured that our food has no trans fat since our “No Trans Fat” campaign was launched 4 to 5 years ago. We are the first company to use organic unrefined sugar in our products. We make our breads by hand, without using any pre-mix, improvers and preservatives, which are considered necessary in most bakeries. That is why we are artisan bakers, as we know what we are doing and follow the fundamentals. Our soups are gluten-free and thickened with only vegetables. Our cakes, cookies, pastries are handmade from scratch and we use organic unrefined sugar. We also buy diligently and responsibly. We purchase good quality and natural ingredients, with a focus on freshness. Our company has always been green. With a motto of “Waste Not”, we always recycle and order exactly to the required quantity. We also believe that we must give back to the society if we have an opportunity to build the business in a sustainable way. For example, our organic coffee is fairtrade and we buy from a UK-based company which contributes 60-80% of its profit back to the grower communities.

13. What are some business ideas you have implemented that created great results in your business or the industry as a whole?

I try to empower my customer with information, enabling them to make informed choices. I am pleased to make a difference and shift the thinking of people in their choice of eating better. Our all day dining concept was introduced in 2003 and it is doing very well. We were one of the first to make breakfast popular by serving a hearty breakfast, which is the most important meal of the day, at an accessible price. At our stores, our products have absolutely no trans fat. It has always been my mission to serve all organic foods in the future, and I see this as a natural progression for Cedele. We are one of the first to introduce freshly-baked organic breads in Singapore in 1997. Initially, there were not many organic ingredient suppliers and virtually no demand for organic products. However there are a lot of people buying organic products now. We are also the first to highlight gluten-free food in our menu. We have a wide range of gluten-free soups and salads for people who are looking for a low-gluten diet. Any small contributions matter and it may take awhile to gain acceptance, but Cedele has always been unafraid to take the first steps and make decisions outside the norm.

14. Can you share with us some ideas of how you maintain the high standards?

We have a buying department whose sole purpose is to examine the freshness of our ingredients and ensure the right temperature for storing them. Our storage capacity is small to discourage holding large volumes. My HACCP (Hazard Analysis and Critical Control Points) team helps to enforce proper production processes to ensure that fresh quality, cleanliness and hygiene practices and standards are maintained. They scrutinize our entire process of buying, receiving, storage, production and delivery of our ingredients and foods. We train our workers from the start on the disciplines that must be adhered to. As we are manufacturers, we control the ingredients for most of the food that we make. Hence we are able to shortlist suppliers who offer innovations (eg. organic unrefined sugar, grapeseed oil) and fulfill certain prerequisites such as having no trans fat, artificial preservatives and flavourings. We work with local and overseas suppliers to deliver quality and freshness according to our specifications. We do not compromise on quality and freshness and if our specifications are not met, we will reject the entire shipment. The method in which we cook our food and the ingredients that we put into our food are also important. Again, we emphasize freshness and the quality of our ingredients.

15. Where or who do you get your business ideas from?

I build my business just from listening to customers who tell me what they need. I always design food by thinking about the impact to the health of my customers, and will not do it if it is not good for them. For example, our flour has no mold inhibitor preservatives and I was educated about this from a customer, who is the president for a club for children with disabilities. Through research, I learnt that margarine has trans fat and is cancer-causing. This was enough reason for me to stick with butter and exclude margarine from my recipes.

16. What do you see for your business in the next 5 years, and does it include any plans for expansion?

It is inevitable for a business to expand and the form must change regardless of which way your business expands. Our proposition is relevant in a Western country and may probably be better-received there than in Singapore. It is our dream to bring our business into the West. Cedele, as a brand, will evolve to a different form, if the market conditions are ready. Another of my dream is to have a group of entrepreneurs working for our company in their own divisions. Our future end-state is to be all-organic. We will also be moving towards more fair trade products. The costs are higher but I believe I can bring positive impact to the lives of the growers.

17. As you are currently working with mainly overseas suppliers, do you have any plans to work with local firms as well?

I do purchase from local suppliers currently. I would love to support and work with more local enterprises. However, it is hard to find suppliers in the region who are able to complement our business. I strongly encourage young enterprises to work with us and we will be very happy to share our thoughts and philosophy. Hopefully, we can create a positive footprint. We admire people with a sense of responsibility and reliability, and they are whom we can resonate and work with.

18. What does entrepreneurship mean to you?

I do not think it should just refer to a quality of a person who has his own start-up. It can also mean a person who works for a company and starts his own project, thus building ownership, creativity and thoroughness in the business. If they drop their ego, which is always what stops people in their businesses, they will succeed. It is about having a thought in the beginning and putting them into a tangible form.

19. In your opinion, what does it mean to have the ‘spirit of enterprise’?

Always think out of the box. Give yourself the permission to take risks and apply the processes that you have learnt. If you do not dare to take risks or only have a small appetite, then work for people but still be an entrepreneur within the organization.

20. Who or what motivates and inspires you?

My ex-company was an US-based multi-national company. It was a socially responsible company which gave back to the society. I had an ex-colleague who stuck quotes at my desk. 2 quotes that stayed with me through the years: One was from Confucius, “If you enjoy what you do, you will never work another day in your life.” Another one is, “The best ideas are usually found in the graveyard.” Many people have good ideas but they never execute or share them in their lives, so their ideas go to the grave with them. This is for entrepreneurs who want to do something but never did. I decided not to procrastinate anymore and drove myself to open my bakery business. Even if things did not work out, I could still go back to the corporate world and my resume will look better. One of my professors told me that we will probably not remember what we have learnt after our course. The one thing he wanted us to remember is the importance of research and to apply this in our working life. I am very lucky to have had many mentors in my life and I pay attention to the people I meet, how they can engage and add value to my life, so that I can be more educated. Education never stops until the end of your life.

21. Would you quit your business and go back to the corporate world again?

It depends. I will not mind if any corporation can engage my service and I can add value to them.

22. What are some of your business values and what would you like to pass down to others, particularly the younger generation?

It is our mission to impact our customers positively by providing higher value in terms of better quality food at very accessible prices. I made a pact with myself years ago that when the company expands, we will not cut back on ingredients: we would want to buy higher quality ingredients but at lower prices because of our larger volume. This will enable us to pass these benefits to our customers. If you have a regular customer base, you cannot take them for granted. You must respect your customers. They will know when you try to cut corners, so do not even try. Believe in yourself. You should learn the right skills as you work and they should become your habits. Be very interested in your surroundings. Be observant, hardworking, methodological and organized. Do the right thing. Do not venture into business just for the sake of money. Stay true and focused.

23. Can you share some of the more significant events / incidents that affected or shaped your business philosophy and the way you conduct your business?

The recent economic downturn affected us a little but not significantly, as we have always been very sensible with controlling our costs. Previous major incidents such as 9/11 and SARS did not affect us adversely. In fact, the reverse was true: it affected our wholesale business to a major airline. When the contract ended with this client, it gave me a new opportunity to focus and open more shops. I see every downturn as an opportunity. I have always been a healthy eater who exercises regularly. When my ageing parents became ill, I read a lot on nutrition to nurse them back to health. This period helped me to be clearer about the position of my company – to advocate “Eat Well, Be Well”. As our customers continue to patronize us over time, we will need to introduce product innovations with health benefits, to provide a solution for their lifestyle change. For example, we just launched grapeseed oil to be used in our cakes and at our all-day dining stores. Grapeseed oil is a better oxygen carrier to the brain. With grapeseed oil, we use less oil now, so less calories. We subscribe to the concept of “less is more”, and it is a win-win strategy.

24. With the changes in the market today, do you think it has become harder or easier to succeed in business? Why do you say so?

Change is constant. In business, you must constantly create a niche for yourself and seek opportunities. There is no such thing as the market being too crowded. The probability of competition is endless. There are a lot of ideas and opportunities in the food business.

25. What advice would you give young people who want to do their own business?

You should start a business that you can handle. Otherwise it becomes overwhelming and you have to give it up when it becomes too difficult. It is about awareness. I hope all young people view their lives this way: apprehension will always be there but enjoy the journey and do not be worried. Ask yourself what is your strength and build your career from there. Think about the topic that you can resonate with, what you can positively contribute to society and never waste time. Do everything legal and help people.

Quote of the Week

“At present we have this rare and good human life of freedom and fortune, but it won’t last forever. We are certain to die and don’t know when. At death nothing at all but our spiritual practice will be of any use to us. That is the only thing worth doing—everything else is a futile waste of energy. We tire ourselves for the sake of reward and reputation and in our search for the kind of companions we prefer, but we can take none of these with us when we die. They must be left behind and only the imprints of negative actions we have performed in the process of trying to acquire them accompany us to our next rebirth. This is not hard to understand, but we must remember it and think about it till it affects the way we think and feel.”

~ Atisha’s Lamp for the Path to Enlightenment, by Geshe Sonam Rinchen, edited and translated by Ruth Sonam, page 31.

Call it any name other than Pilates

Pilates these days has been modified to such an extent that it is no longer what the founder has intended it to be, says the last of the instructors taught by Joseph Pilates.

By Cheah Ui-Hoon

SOME forms of Pilates being taught around the world today – Singapore included – would have met with the approval of the late Joseph Pilates, who devised the exercise method, but some would not.

‘He’d be absolutely livid with some of them, and then others he’d be happy with,’ says Jay Grimes, in his 70s and the last of the first-generation Pilates teachers who had learnt the exercise directly from Joseph and Clara Pilates.

A former contemporary ballet dancer, Mr Grimes had learnt it from the 1960s onwards for more than 10 years, and is pretty much the last one among his cohort who is still teaching – as he realised recently. Ron Fletcher, another first-generation Pilates teacher who had visited Singapore years ago also to teach at Pilates Bodywork Studio, has passed away.

Mr Grimes, who started teaching Pilates in the 1990s, points out that Pilates isn’t something one could learn in a few months or years. ‘To really know and understand it, you’re looking at a minimum of five to 10 years,’ he says. ‘Someone had once said that it’s like peeling an onion – but in this case, the more you peel the more there is to explore.’

Mr Grimes, who started teaching Pilates in the 1990s, points out that Pilates isn’t something one could learn in a few months or years. ‘To really know and understand it, you’re looking at a minimum of five to 10 years,’ he says. ‘Someone had once said that it’s like peeling an onion – but in this case, the more you peel the more there is to explore.’

The problem with Pilates getting hip these days, and becoming so widespread since a certification came into place, is that instructors are giving twists to the exercise so that they can stand out among the crowd. ‘They learn the mechanics of the exercise, do gimmicks with it and call it Pilates. And even if some are doing wonderful things with it, they should call it another name rather than Pilates,’ says Mr Grimes.

That’s because each time the regime is modified, he notes, it detracts from the way that its founder had intended it to be – which is to work the body from inside out: the organs and bones; and for people to be aware of their bodies, and use it correctly, to have energy and vigour and be resistant to disease.

The first time Mr Grimes learnt of Stott Pilates, he relates, he was horrified. Later, he was even more flabbergasted to learn that it was one of his students who had devised it. The Stott method has more to do with therapy than exercise, he points out, so it takes a different approach. ‘Pilates wasn’t meant to replace physical therapy, for example.’

Mr Grimes is resigned to the fact that Pilates may not mean the same from one instructor to another now, but still thinks that if people want to use it differently from the original intention, they should call it by another name.

There is a misconception that Pilates had devised the exercise for dancers. Far from it, says Mr Grimes. Joseph Pilates first taught boxing and self-defence, but when he was interned on the Isle of Man during World War I because of his German nationality, he started working with patients in hospital beds.

‘At that time, the mentality was to keep the patients in bed and as inactive as possible, so they weren’t allowed to get up to exercise,’ explains Mr Grimes. Joseph didn’t agree with that idea, so he started devising a system of springs to work with patients in bed. ‘And that was the basis of the cadillac that you see today in Pilates studios,’ he adds.

As for himself, he has the most cliched story of how he started learning Pilates, he admits. He was keen to embark on a professional dance career in New York City and at his first ballet class there, the ballet master immediately spotted the effects of a mild childhood polio case. ‘Go and look for Joseph Pilates at 939, 8th Avenue, she told me,’ he recalls.

He stopped by to check out the studio and thought it was a medical torture chamber and was about to hightail it out of there when Clara Pilates caught hold of him. ‘Can I help you? She says,’ Mr Grimes relates as if it happened yesterday.

They were very disciplined in those days, he laughs, so he signed up. ‘I was also willing to do anything to be able to dance better,’ says Mr Grimes, who later joined the renowned American Ballet Theatre.

Pilates changed his body and dancing tremendously, but as a dancer, he had looked at the exercise as a means to an end, and never thought of being a full-time instructor. ‘Plus you couldn’t make a living from teaching Pilates, not until the 1990s,’ he says.

The confluence of two events worked in his favour: it was time to retire from dancing, and by the 90s, Pilates was well-known enough for him to teach it full time.

Mr Grimes had learnt from Joseph for about three years, and then after he passed away in 1984, he learnt from Clara for about 10 years. He had also learnt from John Winters, Joseph’s right hand man.

Mr Grimes now teaches at a studio in Los Angeles, but has also embarked on a project with two teachers to photograph and film his exercises. ‘That’s an interesting project – as they are also filming other students and second-generation teachers and making it available online,’ he says.

Pilatesology.com was designed for teachers and students alike – with some clips done as demonstrations and others as instructional. Mr Grimes is very much behind the project because it’s like a repository of the best Pilates knowledge, he adds.

For those keen on learning Pilates, his advice is to look at the teachers’ lineage – ‘You should look for a lineage which is as close to Joseph and Clara Pilates as you can, so that it’s ‘purer’,’ he says. It’s inevitable that teachers will bring their own personalities into it, but at least it won’t be too diluted, he concludes.

Jay Grimes was in Singapore last week to give classes at Pilates Bodywork Studio, at 1 Finlayson Green and Holland Village, run by Alvin Giam, the only Gold Certified teacher by the Pilates Method Alliance International in Asia, and who had studied with many first and second-generation Pilates instructors.

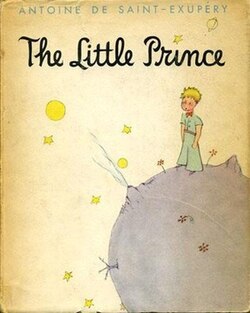

The Little Prince

“What makes the desert beautiful,” said the little prince, “is that somewhere it hides a well…”