Lorde – Royals

Katy Perry – Roar

Andain – Promises (Myon & Shane 54 Summer Of Love Mix)

Organic Delivery in Singapore

Zenxin

organicdelivery.sg

SG Organic

sgorganic.sg

Organic Grocer

www.theorganicgrocer.com

Four Seasons Organic Market

fourseasonsorganic.sg

YiSing Natural

www.natural.sg

Quote of the Week

Quote of the Week

“When a rainbow appears vividly in the sky, you can see its beautiful colors, yet you could not wear it as clothing, or put it on as an ornament. It arises through the conjunction of various factors, but there is nothing about it that can be grasped. Likewise, thoughts that arise in the mind have no tangible existence or intrinsic solidity. There is no logical reason why thoughts, which have no substance, should have so much power over you, nor is there any reason why you should become their slave.

The endless succession of past, present, and future thoughts leads us to believe that there is something inherently and consistently present, and we call it “mind.” But actually… past thoughts are as dead as a corpse. Future thoughts have not yet arisen. So how could these two, which do not exist, be part of an entity which inherently exists?

However, that void nature of mind is not just a blank emptiness like empty space. There is an immediate awareness present. This clarity of mind is like the sun, illuminating the landscape and allowing you to see mountain, path, and precipice—where to go, and where not to go.

Although the mind does have this inherent awareness, to say there is “a mind” is to give a label to something that does not exist—to assume the existence of something that is no more than a name given to a succession of events. One hundred and eight beads strung together, for example, can be called a rosary, but that ‘rosary’ is not a thing that exists inherently on its own. If the string breaks, where did the rosary go?”

~ Dilgo Khyentse Rinpoche, The Heart of Compassion

I Am a Man Who Will Fight for Your Honor

Don’t You Worry Child – Swedish House Mafia cover – Beth

Quote of the Week

“Still round the corner there may wait

A new road or a secret gate

And though I oft have passed them by

A day will come at last when I

Shall take the hidden paths that run

West of the Moon, East of the Sun.”

~ J.R.R. Tolkien

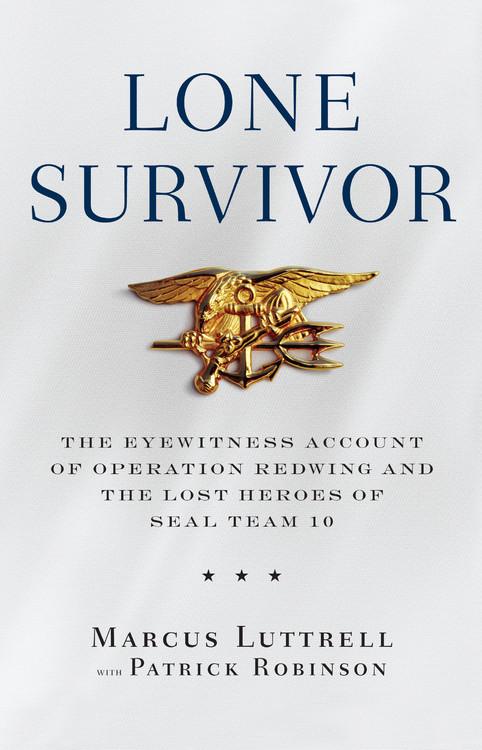

Lone Survivor: The Eyewitness Account of Operation Redwing and the Lost Heroes of SEAL Team 10

NAVY Seal Instructor Reno Alberto (p103):

“This is high-risk training. And we define that as anywhere there is potential for serious injury or loss of life. Any of you see anything unsafe, or any situation where you may be in unnecessary danger, speak up immediately. We do not like mistakes, understand that?

Always remember your own accountability, to yourselves, your superiors, and your teammates. The chain of command is sacred. Use it. Keep your boat crew leaders and your class leaders informed of any digression from the normal. And stay with your swim buddy. I don’t care if you’re going to the head, you stay right with him. Understood?

Integrity, gentlemen. You don’t lie, cheat, or steal. Ever. You lose an item of gear, you put in a chit and report it. You do not take someone else’s gear. I won’t pretend that has not happened here in the past. Because it has. But those guys were instantly finished. Their feet never touched the ground. They were gone. That day. You will respect your classmate. And his gear. You do not take what is not yours. Understood?

Finally, reputation. And your reputation begins right here. And so does the reputation of Class 226. And that’s a reflection on me. It’s a responsibility I take very personally. Because reputation is everything. In life, and especially right here in Coronado. So stay focused. Keep your head right in the game. Put out a hundred percent at all times, because we’ll know if you don’t. And never, ever, leave your swim buddy. Any questions?”

p116:

One time during Indoc while we were out on night run, one of the instructors actually climbed up the outside of a building, came through an open window, and absolutely trashed a guy’s room, threw everything everywhere, emptied detergent over his bed gear. He went back out the way he’d come in, waited for everyone to return, and then tapped on the poor guy’s door and demanded a room inspection. The guy couldn’t work out whether to be furious or heartbroken, but he spent most of the night cleaning up and still had to be in the showers at 0430 with the rest of us.

I asked Reno about this weeks later, and he told me, “Marcus, the body can take damn near anything. It’s the mind that needs training. The question that guy was being asked involved mental strength. Can you handle such injustice? Can you cope with that kind of unfairness, that much of a setback? And still come back with your jaw set, still determined, swearing to God you will never quit? That’s what we’re looking for.”

Payphone – Maroon 5 (Jayesslee Cover)

BT – Skylarking

Full song:

Official Crossfit Affiliates in Singapore

Crossfit Singapore

http://www.crossfitsingapore.com.sg/

81 Ubi Avenue 4 UBI ONE #02- 13 / 14\

Singapore, Singapore

00116596233219

Reebok Crossfit Enduro

http://www.crossfitenduro.com/

#01-03 Syed Alwi Road, 11 Teck Heng

Singapore, Singapore

Crossfit Fire City

http://crossfitfirecity.com/

11 Kampong Bugis 01-05

Singapore, Singapore

Crossfit Hub

http://crossfithub.com/

3 Irving Rd, Irving Industrial Building #01-01

Singapore, Singapore

Crossfit Unit

http://www.crossfitunit.sg/

76 Playfair Road

Singapore, Singapore

Rescuers evacuate 5 Indonesians trapped by tigers

Rescuers evacuate 5 Indonesians trapped by tigers

Fakhrurradzie Gade, The Associated Press, Banda Aceh | World | Mon, July 08 2013, 5:52 PM

World News

Rescuers on Monday reached five men trapped in trees by several Sumatran tigers for five days after the angry animals mauled a sixth man to death, police said.

First Lt. Surya Purba said three tamers managed to drive the tigers away before the men who were in weak condition were evacuated from trees in the protected Mount Leuser National Park in Tamiang, an Aceh district neighboring with North Sumatra province.

The men were looking for rare agarwood — used to make incense and perfume — and accidently caught a tiger cub in a trap they were using to catch deer for food, said district police chief Lt. Col. Dicky Sondani.

The incident caused five other tigers in the area to attack the men, Sondani said, citing reports from villagers who received mobile phone messages Thursday from the survivors. One of the men was mauled to death, while the five others managed to climb into trees.

The rescue team needed three days to reach the rugged area, said Sondani who was worried that the men could be weak and fall from the trees due to a lack of food.

“I received a report from rescuers that they have just evacuated the men after tamers managed to drive away the tigers,” Purba said. “They are all in weak condition.” He added they survived by drinking rain water.

The 28-year-old man who was mauled to death had managed to climb a tree, “but the branch broke, causing him to fall to the ground,” Purba said.

There were seven tigers wandering around the trees but four left before the rescuers arrived, he said.

The rescue team of soldiers, policemen and conservationists was sent after villagers failed to reach the men because of the tigers.

Besides Sumatran tigers, Leuser park is home to other protected animals, including orangutans, elephants, rhinos and leopards.

Sumatran tigers are the most critically endangered tiger subspecies. About 400 remain, down from 1,000 in the 1970s, because of forest destruction and poaching.

Agarwood is relatively rare and is highly valued for its dark aromatic resin, which is used in incense and perfumes.

Ferry Corsten & Betsie Larkin – Not Coming Down

Original Music Video

Floating through the sky again

Will I ever find my way?

Maybe that’s the point of it

Learning that the road don’t end

To look around

Enjoy the sound

And take the beauty in

On this flight

On this height

I don’t care

What the world will say

‘Cause I’m not coming down

‘Cause I’m sure

That the world

That I see

In my mind is changed

And I’m not coming down today

Maybe there are no mistakes

Only what we have to face

So you don’t have to feel regret

Join in for the ride instead

We’re floating now

Above the ground

Hope this will never end

Original Mix

Chantelle Truong Cover

Singapore Legal Practice in the 70’s

The Good Old Days Revisited

At the beginning of the 70s, I had been in practice for only a few years. I had just been made a salaried partner in Allen & Gledhill, which gave me a good pay rise without the responsibilities of full partnership (‘good pay rise’ is of course a relative term: my income as a salaried partner was significantly less than that of a present first year associate in the same firm). My firm was one of the biggest in town (with about a dozen lawyers), yet it was still small enough that I knew the name of every person in the firm (peons included), and partners would lunch with legal assistants on a regular basis.

The legal world was still dominated by the ‘Big 4’ firms which had been founded by expatriates, namely, Donaldson & Burkinshaw, Drew & Napier, Rodyk & Davidson and Allen & Gledhill. However, their dominance was being challenged by two ‘local’ firms, Shook Lin & Bok (which was founded by Malaysians) and Chor Pee & Hin Hiong (which later fell into difficulties with the prosecution and conviction of Khoo Hin Hiong). There were only about 300 practising lawyers at the Bar at the beginning of the decade, so the sense of camaraderie was strong.

Legal practice was relatively leisurely, compared to today’s pace. I thought I was working hard by not going home till after 6pm, and usually had time to go home for a shower before an evening engagement. There was time for an active social life after work despite having to go to the office on Saturday mornings. I even had time to join ‘The Sceneshifters’ (an amateur operatic society) with Woo Tchi Chu and together we formed part of the tenor chorus for operettas like ‘Land of Smiles’ and ‘Rose Marie’.

When we went to the High Court on summons in chambers days, we would walk back to Raffles Place, and have coffee at the G H Café in Battery Road (which is now part of 6 Battery Road) together with its sinfully delicious kaya cake. If we missed coffee, we could always go there for lunch and sit at a table reserved for lawyers (a sort of ‘mess table’). There I lunched with some of the legal giants of the day (such as David Chelliah, K C Chan, Goh Heng Leong, Tan Tee Seng, Tan Wee Kian, Sachi Saurajen and Koh Eng Tian). None of them had any airs and were happy to talk to junior lawyers as equals and share their knowledge and experience with them. Another favourite haunt of lawyers was the Polar Café in High Street, whose curry and cream (custard) puffs were legendary.

When we appeared in the traffic courts against police prosecutors, the magistrates (like Giam Chin Toon) would invite us back into their chambers for coffee after the case was over and we would chat with the magistrate as well as the prosecutor. Relations between bench and bar were much closer then with such regular exchanges, culminating in the Bench and Bar Games against the Malaysians, which really roused the camaraderie of the Singapore lawyers. Our motto when we left for our biennial trips to Malaysia was ‘kalah tidak apa, wang tidak apa, semua tidak apa, style mau’.

Some of the major legal events that happened in the 70s included the following:

•The Law Society was still known as the Advocates and Solicitors Society of Singapore until it became a statutory body known as the Law Society of Singapore on 12 June 1970.

• The Supreme Court of Singapore was established on 9 January 1970 when it formally became independent of the Malaysian Court.

• In 1970 the Revised Edition of the Laws of Singapore was published, replacing the Laws of the Colony of Singapore (1955 Edition).

• The then Prime Minister, Mr Lee Kuan Yew, addressed the Law Society twice in this decade. The first occasion was at our Annual Dinner in 1970, when he criticised the Stock Exchange of Singapore (‘SES’) and urged the Law Society to pay heed to the weaknesses he had identified in the SES. He also defended the abolition of the jury system which had taken place at the end of the previous decade. The second occasion was at our annual dinner in 1977 when he castigated us for not heeding his earlier warning and gave notice of the Government’s intention to:

(a) make voting at Law Society elections compulsory;

(b) appoint a nominee to the Law Society’s council.

Although smoking had not yet been abolished inside air-conditioned buildings at that time, there was an informal ban on smoking when the Prime Minister was in a room, and the ballroom on these two occasions was noticeable for extended bathroom breaks by large sections of the audience, who disappeared into the lobbies outside for a puff or two.

• In 1971, the Attorney-General’s Chambers moved from the present Family Court building in Havelock Road to High Street, next to Parliament House.

• In 1971, Prof Tommy Koh became Dean of the Law Faculty and Prof S Jayakumar became our Head of Mission to the United Nations.

• In 1974, the Singapore Association of Women Lawyers was founded with Farideh Namazie as its first President.

• In 1975, the Board of Legal Education was established by the Legal Profession Act (Cap. 217).

• In 1975, the Subordinate Courts Complex was completed.

• In 1975, the Subordinate Courts Complex was completed.

• In 1979, Phyllis Tan became the first female President of the Law Society and in the same year, TPB Menon became the first local graduate to serve as Vice President.

Lawyers who worked in the Raffles Place area used to visit the office-cum-showroom of the Malayan Law Journal in Raffles Place next to Robinsons to browse through the latest law books. Bashir Mallal was an amazing man, who had no formal legal training but taught himself law to such an extent that he could give legal opinions and was conferred an Honorary LLD by the then University of Singapore. His death in 1972 marked the passing of an era.

Another enduring memory for all lawyers who worked in the Raffles Place area was Robinsons Department Store in Raffles Place (now occupied by OUB Centre) where we would go for lunch or simply window shopping during lunchtime. One day in 1972, I set out for court in the morning and, when I returned, I found that Robinsons had been destroyed by a fire which also killed the kindly liftman who would say hello to me whenever I visited the store. My office (which was next door) had not been damaged by the fire, but suffered damage from the water pumped into the building by firemen anxious to protect it from the flames next door. I found that my carpet had shrunk by several feet owing to the water, and made an unsuccessful claim on our insurance company, which denied liability on the grounds that our fire insurance policy only responded to claims for damage from fire, not water which put out the fire.

My own work experience was being gained incrementally, as I counted many ‘firsts’. My first (and only) murder trial was in 1974 where Amarjeet Singh and I were assigned to defend two robbers who had killed the victim of their crime. Both our clients were convicted and were eventually hanged. My client was most reluctant to appeal against his conviction, and I was only able to persuade him to sign the appeal papers by telling him that his wish to be executed early could not be fulfilled until his co-accused’s appeals had been disposed of. In 1973, I argued my first case in the Court of Appeal which was for a sum of $1,400. Even then, that was not a large sum, and I was fearful of the reception I might receive from the Court of Appeal. To my relief, they heard me out patiently, and gave judgment in my client’s favour which established that the right of a buyer to reject defective goods could be lost after a reasonable time (1972-1974 SLR 189), which I later discussed in an article in 1992 published in the Lloyds Maritime and Commercial Law Quarterly at page 334.

I was also doing a good deal of corporate finance work, as my firm was acting for about a third of the new merchant banks in Singapore, which were at the vanguard of the new kind of corporate work that we were seeing for the first time. IPOs (or flotations, as they were then called) were starting to become popular, and lawyers were beginning to understand the urgency that such work demanded, which would change the pace of legal life (at least in corporate work) forever. I assisted in the first IPO in Singapore of a close-ended investment trust (Harimau), and the first take-over of a publicly listed company under the new Companies Act (Haw Par of M&G).

In the early 1970s the property market was as hot as it is now, and I was fortunate to have a big client from Hong Kong who went on a spending spree in Singapore, buying several large properties and thus underwriting my introduction to conveyancing practice. I also undertook my first experience as a developer’s lawyer for sales of units in an apartment block (Cavenagh House). The market remained on the boil until the Prime Minister announced on 10 September 1973 that only Singaporeans could purchase residential property. Overnight he brought the property market down from its giddy heights (again, this is a relative term: the best apartments were then selling for less than $100 per square foot) and killed the conveyancing market for almost the rest of the decade. I then switched to acting for landlords in granting commercial tenancies (ICB Building and Shing Kwan House) as well as acting for finance companies financing purchases of commercial units (Katong Shopping Centre).

On the extra curricular front, I began my practice of Family Law when I was asked to teach the subject at the University of Singapore as a part-time tutor. This led to my being appointed to a committee to advise the Ministry of Social Affairs on reforms to the Women’s Charter, after which I continued my interest in the subject by actively practising in this area for the rest of my career.

I also committed myself to pro bono activities. With my experience of Family Law, I volunteered for the Panel of Lawyers to assist the Legal Aid Bureau. More interestingly, I also joined the Samaritans of Singapore (‘SOS’) as a consultant, advising their clients who felt suicidal because of legal problems. I served under their first Chair, Margaret Jeyaretnam, wife of Ben and mother of Philip, and a wonderful person in her own right. Eventually, I became Chair of the SOS and served for three terms in that office.

The 70s were therefore a decade when lawyers led a busy (but not too busy) and eventful life and had time for each other. We were certainly a lot poorer than lawyers are now, but (arguably) we enjoyed our lives a little more.

Michael Hwang, SC

AAS NO. 15/1968

Quote of the Week

Once you realize that the road is the goal,

and that you are always on the road,

not to reach a goal but to

enjoy its beauty and its wisdom,

life ceases to be a task and

becomes natural and simple.

In itself an ecstasy.

~ Nisargadatta Maharaj

Quote of the Week

Society does not want individuals that are alert, keen, revolutionary, because such individuals will not fit into the established social pattern and they may break it up. That is why society seeks to hold your mind in its pattern and why your so called education encourages you to imitate, to follow, to conform.

~ Jiddu Krishnamurti

Quote of the Week

“Believe me, you will find more lessons in the woods than in books. Trees and stones will teach you what you cannot learn from masters.”

~ St. Bernard of Clairvaux

Black Coffee feat. Bucie – Turn Me On

Original Mix

Ginerio Seva Afro Deep Edit

Fashion Conglomerates

The largest fashion conglomerates in the world

Richemont (holding company)

www.richemont.com

- Alfred Dunhill

- Baume & Mercier

- Cartier

- Chloe

- IWC

- Lancel

- A. Lange & Söhne

- Jaeger-LeCoultre

- Roger Dubuis

- Montblanc

- Officine Panerai

- Piaget

- Shanghai Tang

- Vacheron Constantin

- Van Cleef & Arpels

LVMH (holding company)

www.lvmh.com

- Louis Vuitton

- Dior

- Fendi

- Loewe

- Céline

- Givenchy

- Marc Jacobs

- Donna Karan

- Emilio Pucci

- Kenzo

- Berluti

- Moynat

- Edun

- Thomas Pink

- TAG Heuer

- Zenith

- Hublot

- Chaumet

- Bulgari

- De Beers

Kering (holding company)

www.kering.com

- Gucci

- Bottega Veneta

- Brioni

- Girard-Perregaux

- Stella McCartney (50%)

- Alexander McQueen (51%)

- Puma

- Saint Laurent Paris

- Sergio Rossi

- Boucheron

- Sowind Group

- JeanRichard

- Queelin

- Christopher Kane (51%)

Prada Group (holding company)

www.pradagroup.com

- Prada

- Miu Miu

- Fendi

- Helmut Lang

- Jil Sander

- Azzedine Alaia

Luxottica (holding company)

www.luxottica.com

- Alain Mikli

- Oakley

- Ray-Ban

- Arnette

- Oliver Peoples

- Persol

- Sunglass Hut

- LensCrafters

- Bulgari Eyewear

- Burberry Eyewear

- Chanel Eyewear

- Dolce & Gabbana Eyewear

- DKNY Eyewear

- Miu Miu Eyewear

- Paul Smith Spectacles

- Prada Eyewear

- Ralph Lauren Eyewear

- Stella McCartney

- Armani Eyewear

- Versace Eyewear

- Stella McCartney Eyewear

- Tiffany & Co Eyewear

Last Night I Dreamed of Peace: The Diary of Dang Thuy Tram

Đặng Thùy Trâm (born November 26, 1942 in Huế, Vietnam; died on June 22, 1970 in Đức Phổ, Quảng Ngãi Province, Vietnam) was a Vietnamese civilian doctor who worked as a battlefield surgeon for North Vietnam during the Vietnam War. She was killed, in disputed circumstances, at the age of 27, by American forces while travelling on a trail in the Ba Tơ jungle in the Quảng Ngãi Province of south-central Vietnam. Her wartime diaries, which chronicle the last two years of her life, attracted international attention following their publication in 2005.

20 June 1970

Now immense sea and sky

Oh, uncle, do you understand this child’s heart…

No, I am no longer a child. I have grown up. I have passed trials of peril, but somehow, at this moment, I yearn deeply for Mom’s caring hand. Even the hand of a dear one or that of an acquaintance would be enough.

Come to me, squeeze my hand, know my loneliness, and give me the love, the strength to prevail on the perilous road before me.

Further reading: http://stanmed.stanford.edu/2007summer/diaries.html

Hardwell feat. Amba Shepherd – Apollo

Quote of the Week

“Sit in a room and read — and read and read. And read the right books by the right people. Your mind is brought onto that level, and you have a nice, mild, slow-burning rapture all the time. This realization of life can be a constant realization in your living. When you find an author who really grabs you, read everything he has done. Don’t say, ‘Oh, I want to know what So-and-so did’—and don’t bother at all with the best-seller list. Just read what this one author has to give you. And then you can go read what he had read. And the world opens up in a way that is consistent with a certain point of view. But when you go from one author to another, you may be able to tell us the date when each wrote such and such a poem—but he hasn’t said anything to you.”

~ Joseph Campbell

Lockheed Martin F-35 Lightning II

蕭亞軒Elva Hsiao – 最熟悉的陌生人The Most Familiar Stranger (官方完整版MV)

The Shanghai rubber bubble of 1910 holds a lesson for today

The Shanghai rubber bubble of 1910 holds a lesson for today

Friday, 12 April, 2013, 12:00am

Business

Tom Holland

Speculative excess has a long pedigree, given how easily human desire for quick gains can overcome concerns about long-term profitability

When you are reputed to be London’s most highly paid hedge fund manager, you can afford to indulge in a few whims.

David Harding’s whims are a tad unusual, however. Among other things, the founder of US$26 billion hedge fund company Winton Capital has endowed a Cambridge University professorship in the public understanding of risk, and is patron of the Harding Centre for Risk Literacy at the Max Planck Institute for Human Development in Berlin.

A former theoretical physicist, Harding sponsors the Royal Society’s Winton Prize for science books, and in 2009 he donated £20 million (HK$238 million) to Cambridge’s Cavendish physics laboratory.

His latest project is equally eclectic. It’s a massive and lavishly illustrated 300-page coffee table history of foolish financial speculations, co-authored with the head of Winton Capital’s historical research department, James Holmes.

Harding and Holmes cover all the obvious episodes, from the Dutch tulipomania of the 17th century, through England’s South Sea Bubble of 1720, right up to the 2007 subprime boom.

But it is in writing about less well known incidents of speculative excess that Harding and Holmes really excel.

They describe the Florentine credit bubble of 1339, punctured when Edward III of England defaulted on his sovereign debt.

They write about the land reclamation and property development frenzy that gripped Bombay in 1863, and the Constantinople crisis of 1895, when the monopoly Ottoman Bank collapsed after investing unwisely in South African mining shares.

Closer to home, they also describe the Shanghai rubber bubble of 1910.

Demand for rubber was already running high in the early years of the 20th century. But when Henry Ford began mass-producing his Model T cars in 1908, it ballooned.

Then, in 1909, when the world’s biggest producer, the Brazilian state of Pará, restricted supplies in an attempt to bump up its income, rubber prices surged.

Rubber plantations in Malaya made huge profits, and paid shareholders handsome dividends.

In an attempt to cash in, Shanghai-based financiers immediately began setting up Malayan rubber companies and selling their shares to eager investors.

Many of these issued prospectuses were “highly mendacious”, write Harding and Holmes, grossly overstating their acreage under rubber.

Even the genuine companies were high-risk investments, however, considering it takes four to five years of growth before rubber trees can be tapped – and before plantation companies can begin paying dividends.

The prospect of quick gains easily trumped such long-term concerns, however, and a lively derivatives market soon developed on rubber shares.

According to one witness, “brokers had the clothes almost torn off their backs by excited plungers who desired to buy shares ‘forward’ at three or four hundred per cent premium”.

And in an account that will resonate loudly today, the British consul at the time described how money flowed into the market from all over China.

“Chinese officials in charge of government and railway funds recklessly cast them into the melting pot in the sure and certain hope of making their fortune.”

The mania couldn’t last, and when American demand for rubber slackened, the market “let out a whoosh of hot air and sank to the ground”.

“Shanghai’s stock exchange, shortly beforehand a hive of activity, sank into a deep torpor that lasted for several years,” write Harding and Holmes.

In the aftermath, several of Shanghai’s leading brokers were convicted of gambling and sentenced to 80 strokes of a bamboo cane before being exiled to at least 3,000 li from the city.

It’s a deterrent that may well appeal to the authorities today.

But if there’s one piece of wisdom to learn from Harding’s latest vanity project, it’s that human folly is timeless.

The threat of punishment won’t make financial markets efficient, and episodes of speculative excess will recur again and again, regardless of any lessons the past may try to teach us.

Quote of the Week

“Time is your most precious gift because you only have a set amount of it. You can make more money, but you can’t make more time. When you give someone your time, you are giving them a portion of your life that you’ll never get back. Your time is your life. That is why the greatest gift you can give someone is your time.

It is not enough to just say relationships are important; we must prove it by investing time in them. Words alone are worthless. “My children, our love should not be just words and talk; it must be true love, which shows itself in action.” Relationships take time and effort, and the best way to spell love is “T-I-M-E.”

~ Rick Warren, The Purpose Driven Life: What on Earth am I Here for?

Friends

“The less you associate with some people, the more your life will improve. Any time you tolerate mediocrity in others, it increases your mediocrity. An important attribute in successful people is their impatience with negative thinking and negative acting people. As you grow, your associates will change. Some of your friends will not want you to go on. They will want you to stay where they are. Friends that don’t help you climb will want you to crawl. Your friends will stretch your vision or choke your dream. Those that don’t increase you will eventually decrease you.

Consider this: Never receive counsel from unproductive people. Never discuss your problems with someone incapable of contributing to the solution, because those who never succeed themselves are always first to tell you how. Not everyone has a right to speak into your life. You are certain to get the worst of the bargain when you exchange ideas with the wrong person. Don’t follow anyone who’s not going anywhere.

With some people you spend an evening: with others you invest it. Be careful where you stop to inquire for directions along the road of life. Wise is the person who fortifies his life with the right friendships. If you run with wolves, you will learn how to howl. But, if you associate with eagles, you will learn how to soar to great heights. “A mirror reflects a man’s face, but what he is really like is shown by the kind of friends he chooses.”

The simple but true fact of life is that you become like those with whom you closely associate – for the good and the bad.

Note: Be not mistaken. This is applicable to family as well as friends. Yes…do love, appreciate and be thankful for your family, for they will always be your family no matter what. Just know that they are human first and though they are family to you, they may be a friend to someone else and will fit somewhere in the criteria above.

“In Prosperity Our Friends Know Us. In Adversity We Know Our friends.”

~ Colin Powell