Category: Investing

Practical housekeeping rules for a healthy financial regimen

Keep good records. When you make a new investment, set up a folder for it. If it is not apparent from the normal paperwork you get, add a sheet that includes all the basic information about the investment, as well as phone numbers where you or your executor can reach someone who can provide more information. Save periodic financial reports.

Keep a file for heirs or your executor. At the minimum, this should include a letter to your spouse or children that tells them where to find or ascertain your investments, insurance policies, will, power of attorney, and so on.

In your file, include a list of people who will be key in handling your affairs after your death or if you are disabled. Provide information about your insurance policies. Put together a list of your investments with their current values, as well as a list detailing the sources of your income now and your survivors’ income sources and amounts.

Rent a safe deposit box at a bank. Think about what would happen if your house burnt down or you lost all of your information in a catastrophe of some kind. Use a safe deposit box to keep original copies of your most vital documents and a backup copy of key computer files.

Review your investment status at least once a year. Calculate the ratio of your fixed income to your equity investments, and rebalance this ratio if necessary in accordance with parameters that you have established.

Always live within your means. It is impossible to stress this too much. If you are still working and you are not saving, you are living beyond your means. If you are retired and you are drawing money too fast from your investments, you are living beyond your means.

Pay attention to your health. Exercising, maintaining a good diet, and taking care of your ears, eyes and teeth not only save you money, they keep you feeling young and active. Even then, the most important kind of insurance for you is likely to be a good medical policy.

Excerpted from Henry Hebeler’s Getting Started In A Financially Secure Retirement, published by John Wiley & Sons.

RIMM (Research in Motion Limited)

Financial adviser's advice on investing: Don't wait

Sunday Times: July 22, 2007

ME & MY MONEY

Financial adviser’s advice on investing: Don’t wait

He invests all his earnings, keeping only six months of emergency cash

By Lorna Tan

MR CHONG, WHO HAS ALREADY MADE ENOUGH TO RETIRE, almost did not start the financial advisory firm he co-founded as it was just after the Sept 11 attacks and the then-banker was sitting pretty on several, more secure career opportunities. — PHOTO: MAY LIN LE GOFF

INERTIA is an investor’s worst enemy. It means time wasted and money forgone.

Straightforward advice and hard to argue with, especially as it comes from Mr Joseph Chong, 45, the founder and chief executive of financial advisory firm New Independent.

‘Every year that you delay saving and investing, it becomes worse and worse,’ he says.

He practises what he preaches and ensures that everything he earns is invested, except for three to six months of emergency cash.

He also advises that people should start learning about investing as soon as they start saving. ‘If you don’t do that, the tuition fee becomes a lot heavier. The mistakes made earlier are cheaper.’

As a child, he showed signs of entrepreneurship when he bred fighting fish and sold them for a profit.

Growing up in a family where money was tight, Mr Chong recalls how he was always scrounging around for scholarships. The St Joseph’s Institution student was on one scholarship after another from Secondary 2 until he finished his master’s degree in Germany.

A former Public Service Commission scholarship holder, he worked at the Ministry of Defence for eight years before joining the banking industry.

New Independent was set up in December 2001 with $400,000. It broke even after two years and is enjoying annual revenue growth of 30 per cent. It takes care of wealth management for high net-worth individuals.

He is married with an eight-year-old daughter. His wife, 42, was an investment banker who retired two years ago.

Q What is your approach to money management?

A Sweat at work but sweat one’s assets harder. This is the approach I have adopted since I started work 18 years ago with $2,000 in my bank account. It was already mathematically clear then that just working and saving wouldn’t do it. To be free from the ‘bondage’ of employment, you must invest and compound your money.

Q What financial planning have you done for yourself and your family?

A We have a comprehensive financial plan drafted in accordance with New Independent’s proprietary financial planning system – The NI Concept Plan (a framework which the firm recommends to clients).

Q What about insurance planning?

A This is an integral part of the plan. Generally, except for critical illness cover, all our policies are effectively term insurance plans.

Q When and how did you get interested in investing?

A I can’t quite remember when but I have always been interested in economics, history and mathematics.

Q What’s your investment philosophy?

A I have always believed in the need to diversify globally and across asset classes.

As a survivor of the Asian crisis and the dot.com bust, I am now an even more unrepentant believer. Like a predator on the stalk, an investor has to be patient.

I am quite happy to grind out 10 to 12 per cent annually on my globally diversified portfolio while watching for an opportunity to exploit extraordinary value opportunities. My overall portfolio generates about 25 per cent returns annually.

Q What has been a bad investment?

A It was a silly foray into club memberships in Batam. I wrote off the entire initial $12,000.

Q Your best investment to date?

A My best portfolio call was a play on falling interest rates in Singapore as the Asian crisis abated in 1998. A $35,000 basket of property securities tripled to $110,000 in eight weeks. That’s a rate of return not to be repeated in a lifetime.

Q Any other investments?

A I have a 2,300 sq ft investment property on Nathan Road that was acquired in 1998 for $1.61 million.

Q Why did you decide to become your own boss?

A Being my own boss was never a goal that I strove for. It is often a necessary evil in pursuing an idea or a passion.

Over and above risking my own capital, my partner and I cut our pay by 90 per cent initially to conserve cash.

It was especially tempting for us not to start. The terrorist attacks of Sept 11, 2001 had just happened. We had other more secure career opportunities dangling before us and we had young families to take care of.

But we saw what happened in Britain when Mrs Margaret Thatcher created the independent financial advisers industry in the late 1980s and we were convinced we could succeed.

Q Money-wise, what were your growing-up years like?

A I grew up with three sisters. My father was a civil servant and my mother a housewife. The tight money meant there was no budget for holidays.

Q Any retirement plans?

A I am very fortunate that financially I now have the option of retirement. But it is highly unlikely that I will be exercising it any time soon.

I hope to continue for another 25 years until I am 70 if my health permits, because I enjoy the challenge of what I am doing.

Q And your home is.. ?

A Home is a 1,324 sq ft condominium along River Valley Road bought for $1.08 million in 1998.

Q And your car is ..?

A A Toyota Altis.

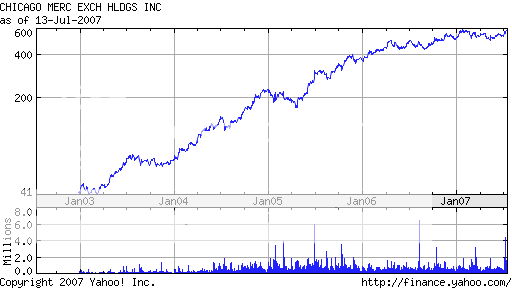

Chicago Mercantile Exchange Holdings Inc. (CME)

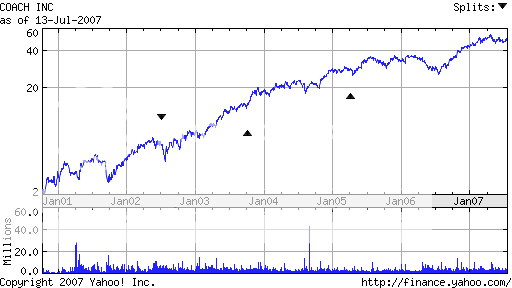

Coach Inc. (COH)

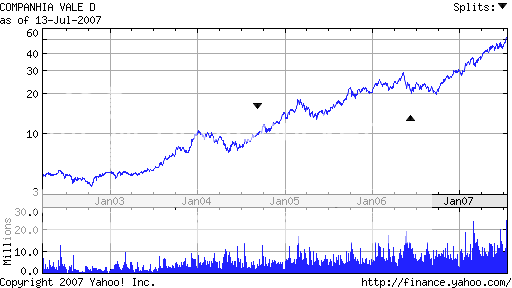

Companhia Vale do Rio Doce (RIO)

Energy agency warns of global oil shortage

LONDON – THE world economy faces a tight oil market in the next five years. This is due to a combination of accelerating consumption and output falls in mature areas, such as the North Sea, and long delays in new production projects.

The warning yesterday by the International Energy Agency (IEA), the energy watchdog, comes as oil prices surge above US$76 a barrel, to within US$2.50 a barrel of last summer’s all-time high of US$78.65.

The IEA said in its Medium Term Oil Market Repot that ‘oil looks extremely tight in five years’ time’ and there are ‘prospects of even tighter natural gas markets at the turn of the decade’.

The IEA forecast that demand will grow at an annual rate of 1.9 per cent during the next five years, to reach 95.8 million barrels per day (bpd) in 2012. China and other emerging countries will lead the increase in consumption.

The new forecast sees oil production growth in the next five years outside the Organisation of Petroleum Exporting Countries (Opec) at 1 per cent, roughly half the rate of demand growth projections.

The widening gap between demand and non-Opec supply will force Opec, the oil cartel which controls about 40 per cent of global oil output, to sharply increase its production between this year and 2012.

The IEA estimates Opec would have to supply about 36.2 million bpd in five years, up from today’s 31.3 million bpd. That would reduce the cartel’s spare capacity to 1.6 per cent of global demand, down from 2 per cent this year.

‘Despite four years of high oil prices, this report sees increasing market tightness beyond 2010, with Opec’s spare capacity declining to minimal levels by 2012.’

FINANCIAL TIMES

Three Reasons why the Value of Gold will rise significantly in 2007

1 Oz. American Eagle Gold Bullion Coin

PRODUCTION DOWN, DEMAND UP.

Every major gold mining country has reported slumping mine production of gold in 2006. As a result of mine strikes, environmental disputes and increasing production costs, global production is continuing to sag and shows no signs of significantly reversing this trend in the near-term. South Africa’s gold-mining output has repeatedly disappointed and this also includes major declines in production in Peru and slumping output in Australia.

“We may see the occasional quarter or monthly production figures that show a spike in production, but the trend is for global production to remain flat to falling in the future,” said research report from Blanchard quoted by Dow Jones in January 2007. “There have been no new world-class discoveries in the last decade, coupled with slashed exploration budgets and industry consolidation.”

1 Oz. Canadian Maple Gold Bullion Coin 99.99% pure

BEATING PLOWSHARES INTO GOLD:

CHINA ENTERS ITS GOLDEN ERA.

Gold ownership for Chinese citizens was legalized in 2004. A system for selling bullion to the largest population in the world is slowly getting off the ground. Once this is established, the effect on gold demand will be staggering. Meanwhile, India, already the world’s largest consumer of gold, is experiencing an 80 percent growth in gold investment following a loosening of trade restrictions.

“Chinese gold consumption is expected to rise 17% this year,” news service Bloomberg quoted China Gold Association chair Cheng Fumin of 2007. “China is the world’s third biggest consumer of the precious metal and is expected to use 350 metric tons this year, up from 300 tons in 2005, owing to an increase in demand for bullion as an investment.”

1 Oz. South African Krugerrand Gold Bullion Coin

CENTRAL BANKS ARE BEGINNING TO DIVERSIFY INTO GOLD.

The effect of central bank policies on the price of gold has always been significant. Today a new era of central bank purchasing is set to begin as the world’s key banks look for diversification of their foreign exchange reserves away from U.S. dollar dominated holdings. The Russian central bank has begun adding gold to reserves, following a commitment to do so in 2006. Other Asian banks are rumored to be planning a similar move. This trend in central bank buying is extremely critical and will have a profound and immediate impact on the gold market in 2007.

“The price of gold will continue to go up and probably very substantially. In the long run, it’s very clear that central banks are basically increasing the supply of money and the supply of gold is obviously very limited.”

— Dr. Marc Faber, January 8th, 2007

NYSE: GOLD

Know when

You’ve got to know when to hold them;

know when to fold them;

know when to walk away;

and know when to run.

Kenny Rogers, from The Gambler